TELECOMS: Inspur Wins Big New Partner with Ericsson Tie-Up

Bottom line: Ericsson’s new tie-up with Inspur looks like a savvy move to gain a foothold in the nation’s fast-growing market to supply infrastructure to power Internet-related products and services.

Chinese IT services firm Inspur has just scored a major new partnership, with word that it’s forming a new tie-up to offer cloud and other Internet-based services with global telecoms equipment leader Ericsson. (Stockholm: ERICb). The new tie-up adds to a growing stable of similar alliances between Inspur and big-name foreign partners, following previous tie-ups with IBM (NYSE: IBM) and Cisco (Nasdaq: CSCO).

We should begin by pointing out that this kind of tie-up isn’t that uncommon for big foreign high-tech names, since Beijing often prefers that such companies form joint ventures for doing business in the vast Chinese market. That drive for tie-ups has accelerated over the last year, following Beijing’s roll-out of a new national security law that requires foreign high-tech product makers to work with Chinese partners when selling to the government or big state-owned companies.

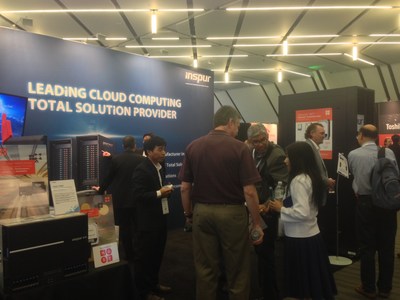

Ericsson and Inspur announced their new partnership at a formal event, saying they have signed a memorandum of understanding (MOU) for cooperation in cloud computing and Internet of things products and services. (company announcement; Chinese article) The announcement got widespread coverage in China but wasn’t heavily covered in the western media, perhaps because the latter remain skeptical of this growing tide of China-western high-tech tie-ups.

The 2 sides have worked together since 2002, when they formed a joint venture to make radio technology and components. As with many of the other recently announced China-foreign tie-ups, this one looks relatively one-way, with Ericsson supplying most of the technology. Inspur will test various Ericsson products, and also help to make sure those products conform with Chinese standards.

Ericsson is coming under pressure as its main networking equipment business slows sharply and it looks for new growth areas. At the same time, Beijing has been strongly encouraging investment in new Internet-based technologies including cloud computing and data storage. Many private companies like Alibaba (NYSE: BABA) and Huawei have launched cloud services, and even foreign names like Amazon (Nasdaq: AMZN) and Microsoft (Nasdaq: MSFT) are active in the China market.

The Internet of things, which sees products like household appliances and cars communicate directly with their owners and each other, has also been a hot area for investment. Here again, nearly all of China’s big private Internet companies have announced tie-ups with various home appliance and car makers to make such devices over the last 2 years, though I have yet to see any real break-out products in the space.

Sensitive Infrastructure

Despite the heavy investment by China’s private sector, much of the telecoms infrastructure used to host such services is still owned by state-run companies due to sensitivity involving potential for cyberspying. That’s one of the main factors driving Ericsson into this latest tie-up, and nearly all the other big global tech names like Hewlett-Packard, Intel (Nasdaq: INTC) and Seagate (Nasdaq: STX) have formed similar tie-ups in the last couple of years.

All of that brings us back to this latest Ericsson tie-up, and what it might mean for the company. At present, the big majority of Ericsson’s China business comes from selling its core networking equipment to the country’s big 3 telcos, China Mobile (HKEx: 941; NYSE: CHL), China Unicom (HKEx: 762; NYSE: CHU) and China Telecom (HKEx: 728; NYSE: CHA). But that growth has been slowing sharply lately in line with global trends, and also due to competition from domestic rivals Huawei and ZTE (HKEx: 763; Shenzhen: 000063).

That said, this new tie-up looks like a shrewd move by Ericsson to diversify into some emerging areas with a partner whose credentials look relatively strong. I doubt that Inspur will add very much to this partnership in terms of technology. But its earlier partnerships with IBM and Cisco seem to indicate it has the experience and connections to help Ericsson gain a foothold for some of its newer product lines in the lucrative but difficult China market.

Related posts:

- TELECOMS: Cisco Courts Beijing with Inspur Tie-Up

- MULTINATIONALS: Seagate Joins China Tech Train with Sugon Tie-Up

- TELECOMS: VMWare Joins China High-Tech Train with New JV

- Today’s top stories