After several years of keeping an extremely low profile, Alibaba founder and chief Jack Ma is suddenly coming back out into the open with some major interviews as the e-commerce giant gets set to embark on what could well become one of the longest roadshows for a China Internet IPO. In all fairness, an IPO may not be the only thing on Ma’s mind right now, following his company’s recent deal to purchase about half of the 40 percent of itself owned by Yahoo (Nasdaq: YHOO). Ma and Alibaba have made it known for a while that they intend to sell most or all of that reacquired stake to new investors, and various reports have appeared over the last month stating interest was coming from various investors, including sovereign wealth funds Temasek of Singapore and China’s own China Investment Corp, also known as CIC. In a strong break with the past few years, Ma himself has granted at least 2 new interviews to major media, with both Bloomberg and the Wall Street Journal featuring stories quoting the founder of China’s largest e-commerce company. (Bloomberg report; Wall Street Journal report) As a former reporter in the China Internet sector, I can recall how Ma was quite keen to do interviews in Alibaba’s early days, when he loved to say how his company and the Internet in general were leveling the playing field for small Chinese entrepreneurs. But then he largely stopped doing interviews over the past few years, as the company’s only publicly traded unit, business-to-business marketplace Alibaba.com (HKEx: 1688), saw its growth slow considerably, and as Alibaba’s relationship with Yahoo soured, and its various units became embroiled in a series of controversies. With many of those issues now settled, including the recent Yahoo purchase and the imminent privatization of Alibaba.com, Ma is clearly feeling more confident about stepping back into the spotlight to start trumpeting his company as it seeks to find major new investors and move towards its ultimate goal of an IPO for the entire group. I’ve had a look at the Wall Street Journal and Bloomberg reports, and have to say there’s nothing really ground breaking in either. Ma confirmed that he’s open to investments from Temasek and CIC, and the group’s CFO Joe Tsai also gave some financials, including that Alibaba’s main 2 consumer focused e-commerce sites, Taobao and TMall, collectively earned around $1.8 billion in revenue last year, and that both have profit margins of more than 50 percent. I suspect that Ma will become more public in the next few months as he courts new investors and tries to raise both his company’s profile and valuation even higher than the $30 billion level set with the Yahoo buyout. In terms of timing, I would expect to see the first big new investors on board as soon as the third quarter, and we could also simply see a single major announcement by the end of the year about a new investor group. As to the IPO, the company has given a time frame of 2015 for the offering, although I wouldn’t be surprised to see that moved up by a year or more if a much needed correction starts to accelerate in China’s e-commerce market and investors start to get nervous.

After several years of keeping an extremely low profile, Alibaba founder and chief Jack Ma is suddenly coming back out into the open with some major interviews as the e-commerce giant gets set to embark on what could well become one of the longest roadshows for a China Internet IPO. In all fairness, an IPO may not be the only thing on Ma’s mind right now, following his company’s recent deal to purchase about half of the 40 percent of itself owned by Yahoo (Nasdaq: YHOO). Ma and Alibaba have made it known for a while that they intend to sell most or all of that reacquired stake to new investors, and various reports have appeared over the last month stating interest was coming from various investors, including sovereign wealth funds Temasek of Singapore and China’s own China Investment Corp, also known as CIC. In a strong break with the past few years, Ma himself has granted at least 2 new interviews to major media, with both Bloomberg and the Wall Street Journal featuring stories quoting the founder of China’s largest e-commerce company. (Bloomberg report; Wall Street Journal report) As a former reporter in the China Internet sector, I can recall how Ma was quite keen to do interviews in Alibaba’s early days, when he loved to say how his company and the Internet in general were leveling the playing field for small Chinese entrepreneurs. But then he largely stopped doing interviews over the past few years, as the company’s only publicly traded unit, business-to-business marketplace Alibaba.com (HKEx: 1688), saw its growth slow considerably, and as Alibaba’s relationship with Yahoo soured, and its various units became embroiled in a series of controversies. With many of those issues now settled, including the recent Yahoo purchase and the imminent privatization of Alibaba.com, Ma is clearly feeling more confident about stepping back into the spotlight to start trumpeting his company as it seeks to find major new investors and move towards its ultimate goal of an IPO for the entire group. I’ve had a look at the Wall Street Journal and Bloomberg reports, and have to say there’s nothing really ground breaking in either. Ma confirmed that he’s open to investments from Temasek and CIC, and the group’s CFO Joe Tsai also gave some financials, including that Alibaba’s main 2 consumer focused e-commerce sites, Taobao and TMall, collectively earned around $1.8 billion in revenue last year, and that both have profit margins of more than 50 percent. I suspect that Ma will become more public in the next few months as he courts new investors and tries to raise both his company’s profile and valuation even higher than the $30 billion level set with the Yahoo buyout. In terms of timing, I would expect to see the first big new investors on board as soon as the third quarter, and we could also simply see a single major announcement by the end of the year about a new investor group. As to the IPO, the company has given a time frame of 2015 for the offering, although I wouldn’t be surprised to see that moved up by a year or more if a much needed correction starts to accelerate in China’s e-commerce market and investors start to get nervous.

Bottom line: With many of its issues now behind it, Alibaba will raise its profile in the next few months as it seeks new investors and starts to build hype in the run-up to its eventual IPO.

Related postings 相关文章:

◙ Alibaba Buyout: Finally Something for Investors 阿里巴巴筹资为机构投资者提供良机

◙ Yahoo, Alibaba in Slow-Motion Divorce 雅虎和阿里巴巴踏上漫漫离婚路

◙ China: Room for How Many Amazons? 中国电商市场到底有多大?

Alibaba appears to be feeling the pinch that has hit most of its major rivals over the last year as they engage in a nonstop game of cutthroat competition, with news that China’s e-commerce leader is doing the once unthinkable: offering discounts. At the same time, media are reporting the company has also become the latest entrant to the online book-selling business, again reflecting the overheated competition that has gripped the market as everyone battles with everyone else in just about every major product category. To understand the significance of this latest news, we need to look first at Alibaba’s e-commerce model, which is quite different from that of its major rivals like Jingdong Mall, which also goes by the name of 360Buy, and Dangdang (NYSE: DANG). Whereas nearly all of its major rivals directly sell their merchandise to consumers, Alibaba uses a model that see it acting as middleman for other online retailers by letting them set up shops on its online TMall platform, formerly known as Taobao Mall. That means that Alibaba, as a middleman platform operator, has largely avoided the recent price wars infecting most of its rivals, whose margins have plummeted as they offered steep discounts to maintain their market position. Now it appears that Alibaba is also feeling some of this price-war pain, as the company reportedly prepares to help the merchants on its TMall platform by providing $47 million in rebates for sales of their various electronics, from cellphones to televisions and air conditioners. (

Alibaba appears to be feeling the pinch that has hit most of its major rivals over the last year as they engage in a nonstop game of cutthroat competition, with news that China’s e-commerce leader is doing the once unthinkable: offering discounts. At the same time, media are reporting the company has also become the latest entrant to the online book-selling business, again reflecting the overheated competition that has gripped the market as everyone battles with everyone else in just about every major product category. To understand the significance of this latest news, we need to look first at Alibaba’s e-commerce model, which is quite different from that of its major rivals like Jingdong Mall, which also goes by the name of 360Buy, and Dangdang (NYSE: DANG). Whereas nearly all of its major rivals directly sell their merchandise to consumers, Alibaba uses a model that see it acting as middleman for other online retailers by letting them set up shops on its online TMall platform, formerly known as Taobao Mall. That means that Alibaba, as a middleman platform operator, has largely avoided the recent price wars infecting most of its rivals, whose margins have plummeted as they offered steep discounts to maintain their market position. Now it appears that Alibaba is also feeling some of this price-war pain, as the company reportedly prepares to help the merchants on its TMall platform by providing $47 million in rebates for sales of their various electronics, from cellphones to televisions and air conditioners. ( The crowded field of couriers that deliver millions of packages each year from China’s booming e-tailers to online buyers is gearing up for a much needed consolidation, which will improve both safety and reliability for a key link in the process of moving merchandise from online stores to consumers. Recent months have seen a steady stream of reports on a wide range of problems with the courier sector, which has grown at a breakneck pace to service an e-commerce industry that generated 588 billion yuan ($92.23 billion) in sales last year, with the number expected to grow another 30 percent in 2012, according to the Commerce Ministry. Most of the sector’s current problems center on reliability, with cutthroat competition and little government oversight meaning that many smaller companies are tottering on the brink of bankruptcy as they struggle to efficiently deliver thousands of packages. Safety is also a concern, as many smaller couriers lack the resources to properly police the products they deliver. Facing this unruly market with the potential to undermine consumer confidence, many of the country’s top e-commerce firms have moved to forge their own delivery networks. Leading e-commerce companies Alibaba and Jingdong Mall, also called 360Buy, have both taken recent steps to build up their own courier services and ensure the reliability of third-party couriers they use. In one of the newest steps in that direction, reports emerged last week that Suning.com (Shenzhen: 002024), the website of one of China’s top electronics retailers, would launch a plan to make products purchased on its website available for pick-up at any of Suning’s 1,800 real-world shops throughout China. (

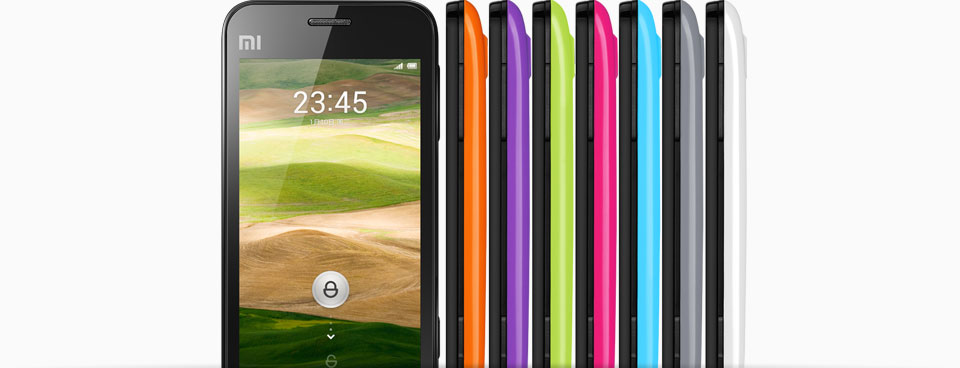

The crowded field of couriers that deliver millions of packages each year from China’s booming e-tailers to online buyers is gearing up for a much needed consolidation, which will improve both safety and reliability for a key link in the process of moving merchandise from online stores to consumers. Recent months have seen a steady stream of reports on a wide range of problems with the courier sector, which has grown at a breakneck pace to service an e-commerce industry that generated 588 billion yuan ($92.23 billion) in sales last year, with the number expected to grow another 30 percent in 2012, according to the Commerce Ministry. Most of the sector’s current problems center on reliability, with cutthroat competition and little government oversight meaning that many smaller companies are tottering on the brink of bankruptcy as they struggle to efficiently deliver thousands of packages. Safety is also a concern, as many smaller couriers lack the resources to properly police the products they deliver. Facing this unruly market with the potential to undermine consumer confidence, many of the country’s top e-commerce firms have moved to forge their own delivery networks. Leading e-commerce companies Alibaba and Jingdong Mall, also called 360Buy, have both taken recent steps to build up their own courier services and ensure the reliability of third-party couriers they use. In one of the newest steps in that direction, reports emerged last week that Suning.com (Shenzhen: 002024), the website of one of China’s top electronics retailers, would launch a plan to make products purchased on its website available for pick-up at any of Suning’s 1,800 real-world shops throughout China. ( After witnessing a steady stream of puzzling moves into the smartphone space by Internet companies in recent months, I’m happy to say I’m finally seeing 2 new moves that I like by sector leaders Baidu (Nasdaq: BIDU) and Sina (Nasdaq: SINA). The rush into smartphones has seen many major Internet firms launch their own new products in the last 12 months, from Internet giant Tencent (HKEx: 700) to e-commerce giant Alibaba, security software specialist Qihoo 360 (NYSE: QIHU) and game operator Shanda. Clearly these companies are trying to grab a share of the fast-growing mobile Internet market, which could easily overtake traditional desktop web surfing in just a few years with the explosion of 3G services and smartphones. But rather than partner with strong players using existing mobile platforms, many of these new initiatives are pairing with less experienced cellphone makers like home electronics giants Haier and Changhong, meaning their chances of success are very limited. That’s why I like these 2 new deals with Baidu and Sina, which will see each company partner with a strong smartphone player in a very targeted way rather than trying to develop completely new models. In Baidu’s case, China’s leading search engine is reportedly close to a deal that will see its mobile search engines pre-installed on Apple’s (Nasdaq: AAPL) wildly popular iPhones sold in China. (

After witnessing a steady stream of puzzling moves into the smartphone space by Internet companies in recent months, I’m happy to say I’m finally seeing 2 new moves that I like by sector leaders Baidu (Nasdaq: BIDU) and Sina (Nasdaq: SINA). The rush into smartphones has seen many major Internet firms launch their own new products in the last 12 months, from Internet giant Tencent (HKEx: 700) to e-commerce giant Alibaba, security software specialist Qihoo 360 (NYSE: QIHU) and game operator Shanda. Clearly these companies are trying to grab a share of the fast-growing mobile Internet market, which could easily overtake traditional desktop web surfing in just a few years with the explosion of 3G services and smartphones. But rather than partner with strong players using existing mobile platforms, many of these new initiatives are pairing with less experienced cellphone makers like home electronics giants Haier and Changhong, meaning their chances of success are very limited. That’s why I like these 2 new deals with Baidu and Sina, which will see each company partner with a strong smartphone player in a very targeted way rather than trying to develop completely new models. In Baidu’s case, China’s leading search engine is reportedly close to a deal that will see its mobile search engines pre-installed on Apple’s (Nasdaq: AAPL) wildly popular iPhones sold in China. ( When historians write about the China Internet bubble of 2011-2012 years from now, they are likely to feature Russia’s Digital Sky Technologies (DST) as perhaps the biggest foreign force that pumped in big sums of money and drove up valuations to unsustainable levels. The company, which rose to prominence as an early investor in Facebook (Nasdaq: FB), has been a steady investor in Chinese Internet companies, and is now making headlines yet again with another reported purchase of a stake in Xiaomi, an up-and-coming maker of low-cost, high-performance smartphones. (

When historians write about the China Internet bubble of 2011-2012 years from now, they are likely to feature Russia’s Digital Sky Technologies (DST) as perhaps the biggest foreign force that pumped in big sums of money and drove up valuations to unsustainable levels. The company, which rose to prominence as an early investor in Facebook (Nasdaq: FB), has been a steady investor in Chinese Internet companies, and is now making headlines yet again with another reported purchase of a stake in Xiaomi, an up-and-coming maker of low-cost, high-performance smartphones. ( After reports emerged last week that e-commerce giant Jingdong Mall’s on-again-off-again IPO was on again, it now appears the company is fast-tracking the deal with plans to list as soon as September, providing a big test for the anemic market for Chinese Internet IPOs in the US. It’s still too early to say how this IPO will fare, since it’s still at least 4 months away and a lot can happen to broader market sentiment in that time. Reports last week said that revenue at Jingdong, which also is known as 360Buy, reached 21 billion yuan and are expected to double this year. (

After reports emerged last week that e-commerce giant Jingdong Mall’s on-again-off-again IPO was on again, it now appears the company is fast-tracking the deal with plans to list as soon as September, providing a big test for the anemic market for Chinese Internet IPOs in the US. It’s still too early to say how this IPO will fare, since it’s still at least 4 months away and a lot can happen to broader market sentiment in that time. Reports last week said that revenue at Jingdong, which also is known as 360Buy, reached 21 billion yuan and are expected to double this year. (