Domestic media have been buzzing for several days now about reports of massive layoffs at telecoms equipment giant Huawei, prompting the company to finally come out and deny the rumors. But where there’s smoke there’s usually fire, and I suspect that Huawei is playing with words to try and downplay the fact that indeed it is having to make some big adjustments to its workforce as its breakneck growth of recent years slows considerably due to a wide range of issues. Let’s look at the reports first, which quote a Huawei spokesman saying the company has made no large-scale layoffs recently, though he didn’t rule out future cuts. (English article) It’s hard to guess what’s really happening at Huawei, since rumors of layoffs usually come from affected employees who may know the situation in their own departments but aren’t really informed about the bigger picture. At the same time, companies themselves — especially in China — are usually reluctant to ever admit to large-scale layoffs, even though job cuts are relatively common, especially in former state-run enterprises trying to become more market-oriented. In this particular case, I would guess that Huawei has already drafted a plan to cut perhaps up to 10 percent of its workforce, and is starting to execute that plan without making an official announcement. Since the company has been keen to show the world its more transparent side, as part of an effort to distance itself from suspicions that it’s controlled by Beijing, I would expect it might actually make a formal announcement on its workforce “adjustment” plan perhaps as soon as September or October. No one should be all that surprised by such an announcement. To the contrary, some might even find such it refreshing that a Chinese company of that size is being more open about the recent challenges it has faced in most of its major global markets. Those challenges for both Huawei and crosstown rival ZTE (HKEx: 763; Shenzhen 000063) have been numerous over the last year. Huawei itself has seen several major initiatives blocked in the US and Australia in recent months, and is now reportedly being investigated in the European Union for receiving unfair subsidies from Beijing. (previous post) One of its other major markets, India, is also caught up in a domestic corruption scandal that has slowed purchasing of new telecoms equipment to a crawl. Meantime, spending in Huawei’s home market is also slowing after a boom over the last 3 years as China’s 3 telcos built up their 3G networks. Huawei has tried to offset the slowdown in its traditional networking equipment business by building up its cellphone unit, but even that will take time. In the meantime, the company may be suffering with growing numbers of underemployed workers and idle production lines, necessitating this upcoming “adjustment” to its workforce.

Domestic media have been buzzing for several days now about reports of massive layoffs at telecoms equipment giant Huawei, prompting the company to finally come out and deny the rumors. But where there’s smoke there’s usually fire, and I suspect that Huawei is playing with words to try and downplay the fact that indeed it is having to make some big adjustments to its workforce as its breakneck growth of recent years slows considerably due to a wide range of issues. Let’s look at the reports first, which quote a Huawei spokesman saying the company has made no large-scale layoffs recently, though he didn’t rule out future cuts. (English article) It’s hard to guess what’s really happening at Huawei, since rumors of layoffs usually come from affected employees who may know the situation in their own departments but aren’t really informed about the bigger picture. At the same time, companies themselves — especially in China — are usually reluctant to ever admit to large-scale layoffs, even though job cuts are relatively common, especially in former state-run enterprises trying to become more market-oriented. In this particular case, I would guess that Huawei has already drafted a plan to cut perhaps up to 10 percent of its workforce, and is starting to execute that plan without making an official announcement. Since the company has been keen to show the world its more transparent side, as part of an effort to distance itself from suspicions that it’s controlled by Beijing, I would expect it might actually make a formal announcement on its workforce “adjustment” plan perhaps as soon as September or October. No one should be all that surprised by such an announcement. To the contrary, some might even find such it refreshing that a Chinese company of that size is being more open about the recent challenges it has faced in most of its major global markets. Those challenges for both Huawei and crosstown rival ZTE (HKEx: 763; Shenzhen 000063) have been numerous over the last year. Huawei itself has seen several major initiatives blocked in the US and Australia in recent months, and is now reportedly being investigated in the European Union for receiving unfair subsidies from Beijing. (previous post) One of its other major markets, India, is also caught up in a domestic corruption scandal that has slowed purchasing of new telecoms equipment to a crawl. Meantime, spending in Huawei’s home market is also slowing after a boom over the last 3 years as China’s 3 telcos built up their 3G networks. Huawei has tried to offset the slowdown in its traditional networking equipment business by building up its cellphone unit, but even that will take time. In the meantime, the company may be suffering with growing numbers of underemployed workers and idle production lines, necessitating this upcoming “adjustment” to its workforce.

Bottom line: Huawei has very likely created a plan to cut up to 10 percent of its workforce, as it tries to adjust following setbacks in many of its major markets.

Related postings 相关文章:

◙ West Launches New Attack on Huawei, ZTE 西方对华为和中兴通讯发起新攻击

It’s the beginning of June, and that means it’s time for the nation’s automakers to release their monthly sales data that will undoubtedly show modest to moderate growth, with the possible exception of some domestic automakers that are suffering in the industry’s current slowdown. But the real picture could be far worse than those reports indicate, based on the latest cautionary words from the nation’s biggest association of auto dealers. Those words of caution from the China Automobile Dealers Association come less than a month after the group warned that inventories of unsold cars were rising above what is normally considered healthy levels at dealerships selling 3 of the nation’s top brands, Geely (HKEx: 175), Chery and BYD (HKEx: 1211; Shenzhen: 002594), as well as at Honda (Tokyo: 7267) dealerships. (

It’s the beginning of June, and that means it’s time for the nation’s automakers to release their monthly sales data that will undoubtedly show modest to moderate growth, with the possible exception of some domestic automakers that are suffering in the industry’s current slowdown. But the real picture could be far worse than those reports indicate, based on the latest cautionary words from the nation’s biggest association of auto dealers. Those words of caution from the China Automobile Dealers Association come less than a month after the group warned that inventories of unsold cars were rising above what is normally considered healthy levels at dealerships selling 3 of the nation’s top brands, Geely (HKEx: 175), Chery and BYD (HKEx: 1211; Shenzhen: 002594), as well as at Honda (Tokyo: 7267) dealerships. ( I hope readers will excuse me for my headline calling an upcoming IPO by China’s top nuclear power company “too hot to handle,” but in all honesty that’s really what I think about this plan, which seems ill conceived and likely to highlight just how unpopular nuclear power is right now. The plan being discussed has just been approved by China’s environmental regulator, and would see China National Nuclear Power Co raise funds to develop $27 billion worth of projects in its pipeline. (

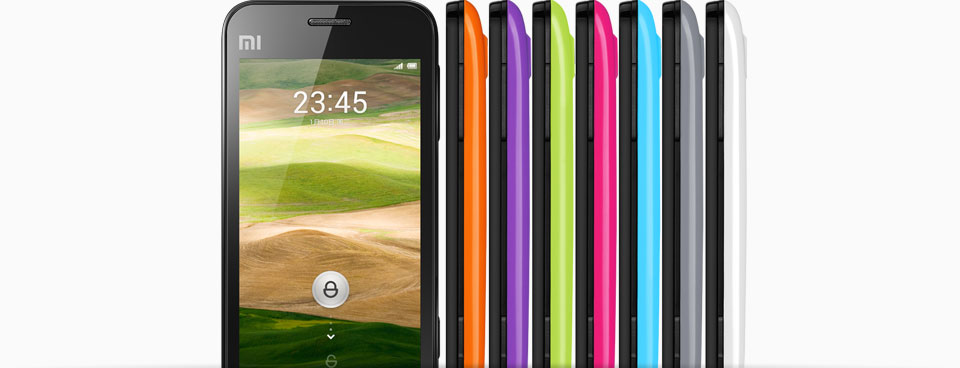

I hope readers will excuse me for my headline calling an upcoming IPO by China’s top nuclear power company “too hot to handle,” but in all honesty that’s really what I think about this plan, which seems ill conceived and likely to highlight just how unpopular nuclear power is right now. The plan being discussed has just been approved by China’s environmental regulator, and would see China National Nuclear Power Co raise funds to develop $27 billion worth of projects in its pipeline. ( When historians write about the China Internet bubble of 2011-2012 years from now, they are likely to feature Russia’s Digital Sky Technologies (DST) as perhaps the biggest foreign force that pumped in big sums of money and drove up valuations to unsustainable levels. The company, which rose to prominence as an early investor in Facebook (Nasdaq: FB), has been a steady investor in Chinese Internet companies, and is now making headlines yet again with another reported purchase of a stake in Xiaomi, an up-and-coming maker of low-cost, high-performance smartphones. (

When historians write about the China Internet bubble of 2011-2012 years from now, they are likely to feature Russia’s Digital Sky Technologies (DST) as perhaps the biggest foreign force that pumped in big sums of money and drove up valuations to unsustainable levels. The company, which rose to prominence as an early investor in Facebook (Nasdaq: FB), has been a steady investor in Chinese Internet companies, and is now making headlines yet again with another reported purchase of a stake in Xiaomi, an up-and-coming maker of low-cost, high-performance smartphones. ( A sudden flurry of aviation news in the Chinese media leads me to suspect the government has issued a new directive for the country’s airlines to be more global, setting the stage for what could be an interesting worldwide expansion that could even include some mergers and acquisitions. Of course, I’m ultimately quite cynical about this kind of government directive, if that’s indeed what is driving this recent flurry of news, as it’s a typical move driven by central leaders in Beijing rather than market forces. But that said, I shouldn’t downplay the importance of support from Beijing for this new global drive, since the success of any global expansion will clearly require such support. Let’s look at the flurry of news first to give a flavor of what’s happening. Leading off the reports, Sichuan Airlines is in the headlines as it becomes one of China’s first regional carriers to launch international service to a Western market, in this case to the Canadian city of Vancouver. (

A sudden flurry of aviation news in the Chinese media leads me to suspect the government has issued a new directive for the country’s airlines to be more global, setting the stage for what could be an interesting worldwide expansion that could even include some mergers and acquisitions. Of course, I’m ultimately quite cynical about this kind of government directive, if that’s indeed what is driving this recent flurry of news, as it’s a typical move driven by central leaders in Beijing rather than market forces. But that said, I shouldn’t downplay the importance of support from Beijing for this new global drive, since the success of any global expansion will clearly require such support. Let’s look at the flurry of news first to give a flavor of what’s happening. Leading off the reports, Sichuan Airlines is in the headlines as it becomes one of China’s first regional carriers to launch international service to a Western market, in this case to the Canadian city of Vancouver. ( After reports emerged last week that e-commerce giant Jingdong Mall’s on-again-off-again IPO was on again, it now appears the company is fast-tracking the deal with plans to list as soon as September, providing a big test for the anemic market for Chinese Internet IPOs in the US. It’s still too early to say how this IPO will fare, since it’s still at least 4 months away and a lot can happen to broader market sentiment in that time. Reports last week said that revenue at Jingdong, which also is known as 360Buy, reached 21 billion yuan and are expected to double this year. (

After reports emerged last week that e-commerce giant Jingdong Mall’s on-again-off-again IPO was on again, it now appears the company is fast-tracking the deal with plans to list as soon as September, providing a big test for the anemic market for Chinese Internet IPOs in the US. It’s still too early to say how this IPO will fare, since it’s still at least 4 months away and a lot can happen to broader market sentiment in that time. Reports last week said that revenue at Jingdong, which also is known as 360Buy, reached 21 billion yuan and are expected to double this year. ( Oil exploration giant CNOOC (HKEx: 883; NYSE: CEO) is probably starting to wish it had never partnered with ConocoPhillips (NYSE: COP) to develop oil fields in the Bohai Bay off the northeast China coast, following word that yet another leak has occurred at the problematic project. Frankly speaking, it’s hard to determine how bad the latest spill was at the Penglai oil fields being developed by ConocoPhillips in this troubled joint venture with CNOOC. The latest announcement from CNOOC indicates the spill was relatively minor, with around half a ton of oil leaked into the sea, all of which has already been cleaned up. (

Oil exploration giant CNOOC (HKEx: 883; NYSE: CEO) is probably starting to wish it had never partnered with ConocoPhillips (NYSE: COP) to develop oil fields in the Bohai Bay off the northeast China coast, following word that yet another leak has occurred at the problematic project. Frankly speaking, it’s hard to determine how bad the latest spill was at the Penglai oil fields being developed by ConocoPhillips in this troubled joint venture with CNOOC. The latest announcement from CNOOC indicates the spill was relatively minor, with around half a ton of oil leaked into the sea, all of which has already been cleaned up. (