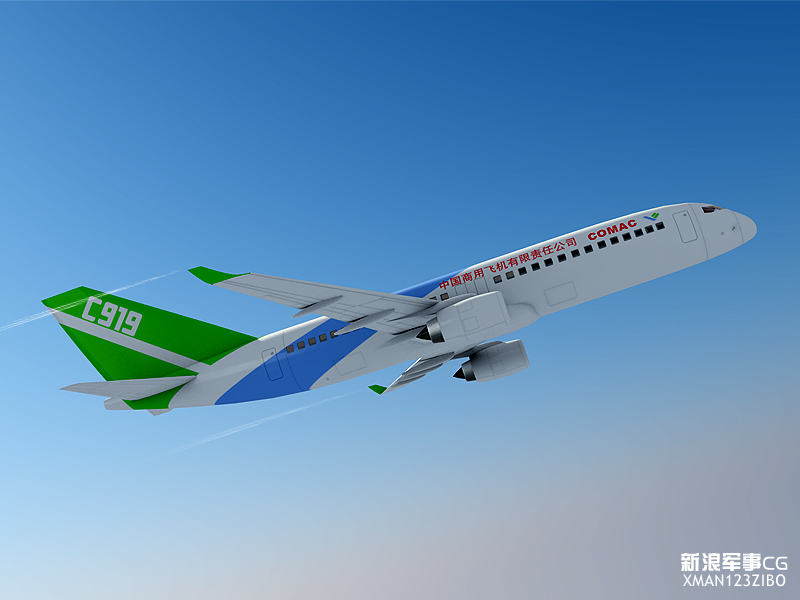

If you can’t sell your products, then create a customer to buy them. That concept has been practiced for years by companies looking to sell their new products to wary buyers, with Chinese solar panel maker Suntech (NYSE: STP) most recently trying out the strategy to largely disastrous results. Now it seems that aspiring Chinese commercial aircraft maker COMAC is also trying out the strategy, with news that the company will participate in the revival of storied but now defunct US carrier Eastern Air Lines. (English article)

If you can’t sell your products, then create a customer to buy them. That concept has been practiced for years by companies looking to sell their new products to wary buyers, with Chinese solar panel maker Suntech (NYSE: STP) most recently trying out the strategy to largely disastrous results. Now it seems that aspiring Chinese commercial aircraft maker COMAC is also trying out the strategy, with news that the company will participate in the revival of storied but now defunct US carrier Eastern Air Lines. (English article)

Vipshop, Renren Search for Profits 唯品会与人人网业绩迥异

Two very different stories are emerging from the latest results of discount online retailer Vipshop (NYSE: VIPS) and social networking site Renren (NYSE: RENN), which are both trying desperately to escape from the loss column amid growing investor impatience with money-losing Chinese web firms. On the one hand, Vipshop’s latest results show it is likely to emerge into the profit column in the final quarter of this year, prompting cheers from investors. But Renren appears to be moving in the opposite direction, reporting a widening loss as China’s ad market worsens. Meantime, new details are also emerging on the latest fund-raising by e-commerce giant Jingdong Mall, which also points to growing investor impatience with money losing web firms.

Two very different stories are emerging from the latest results of discount online retailer Vipshop (NYSE: VIPS) and social networking site Renren (NYSE: RENN), which are both trying desperately to escape from the loss column amid growing investor impatience with money-losing Chinese web firms. On the one hand, Vipshop’s latest results show it is likely to emerge into the profit column in the final quarter of this year, prompting cheers from investors. But Renren appears to be moving in the opposite direction, reporting a widening loss as China’s ad market worsens. Meantime, new details are also emerging on the latest fund-raising by e-commerce giant Jingdong Mall, which also points to growing investor impatience with money losing web firms.

News Digest: November 14 报摘: 2012年11月14日

The following press releases and media reports about Chinese companies were carried on November 14. To view a full article or story, click on the link next to the headline.

══════════════════════════════════════════════════════

- China Sells Jetliners, May Spur Eastern Air Lines Revival (English article)

- LDK Solar (NYSE: LDK) Reaches Agreement to Terminate Wafer Contract (PRNewswire)

- Huntsman, Sinopec (HKEx: 386) In JV To Build, Operate Nanjing PO/MTBE Facility (PRNewswire)

- Renren (NYSE: RENN) Announces Unaudited Q3 2012 Financial Results (PRNewswire)

- Apple (Nasdaq: AAPL) Appeals 520,000 Yuan Award in China Encyclopedia Case (Chinese article)

- Latest calendar for Q3 earnings reports (Earnings calendar)

Alibaba Raises Profits, Jingdong Raises Money 阿里巴巴净利翻番 京东商城完成新融资

New reports from the e-commerce space show that Alibaba continues to dominate the sector with its popular TMall, even as leading rival Jingdong Mall shows no signs of easing its challenge as it has raised $400 million in new funds. Before I go any further in this discussion, I should add a disclaimer saying that both of these companies are private and not required to disclose any information publicly. As such, both have become masters at strategically giving or leaking information to the media that plays to their greatest advantage. That said, there’s usually at least some truth to the information they release, which is what makes it worth looking at.

New reports from the e-commerce space show that Alibaba continues to dominate the sector with its popular TMall, even as leading rival Jingdong Mall shows no signs of easing its challenge as it has raised $400 million in new funds. Before I go any further in this discussion, I should add a disclaimer saying that both of these companies are private and not required to disclose any information publicly. As such, both have become masters at strategically giving or leaking information to the media that plays to their greatest advantage. That said, there’s usually at least some truth to the information they release, which is what makes it worth looking at.

eBay, Xiu: A Smart Partnership eBay牵手走秀网为明智之举

A couple of weeks after news first leaked out of eBay’s (Nasdaq: EBAY) return to China through a new partnership with an online fashion seller (previous post), we’re getting more details about the tie-up with Xiu.com. My major takeaway is that this looks like a smart, well-conceived arrangement that could have a strong chance of success. EBay seems to have learned some important lessons and is applying them to this new tie-up, following its previous Chinese foray that began nearly a decade ago and ended in a failure costing the company hundreds of millions of dollars.

A couple of weeks after news first leaked out of eBay’s (Nasdaq: EBAY) return to China through a new partnership with an online fashion seller (previous post), we’re getting more details about the tie-up with Xiu.com. My major takeaway is that this looks like a smart, well-conceived arrangement that could have a strong chance of success. EBay seems to have learned some important lessons and is applying them to this new tie-up, following its previous Chinese foray that began nearly a decade ago and ended in a failure costing the company hundreds of millions of dollars.

SouFun Results: Real Estate Pick-Up 搜房业绩:房屋交易回暖

![]() The latest quarterly results from online real estate services firm SouFun (NYSE: SFUN) point to a pick-up in real estate buying and selling, which should benefit names like SouFun and rival E-House (NYSE: EJ) that benefit from sales activity and are less concerned with pricing trends. SouFun has given us a wide range of numbers in its latest quarterly report, but the one that caught my attention was the company’s decision to raise its 2012 revenue outlook to $400-$420 million, from a previous outlook of $390-$410 million.

The latest quarterly results from online real estate services firm SouFun (NYSE: SFUN) point to a pick-up in real estate buying and selling, which should benefit names like SouFun and rival E-House (NYSE: EJ) that benefit from sales activity and are less concerned with pricing trends. SouFun has given us a wide range of numbers in its latest quarterly report, but the one that caught my attention was the company’s decision to raise its 2012 revenue outlook to $400-$420 million, from a previous outlook of $390-$410 million.

News Digest: November 13 报摘: 2012年11月13日

The following press releases and media reports about Chinese companies were carried on November 13. To view a full article or story, click on the link next to the headline.

══════════════════════════════════════════════════════

- Alibaba Group Q2 Profit Doubles to $270 Mln (Chinese article)

- Jingdong Mall Raises $400 Mln in New Fund Raising Round – Source (Chinese article)

- eBay (Nasdaq: EBAY) Joins with Xiu.com to Bring Global Style to China (Businesswire)

- SouFun (NYSE: SFUN) Announces Q3 2012 Results (PRNewswire)

- Gaopeng to Achieve Profitability in 2013 (English article)

- Latest calendar for Q3 earnings reports (Earnings calendar)

China Suffers Cold in Hollywood 中国投资好莱坞需谨慎

China is finding out quickly that Hollywood may be all glitter and sparkle on the outside, but it’s quite a different world to insiders where cutthroat competition is more the norm and laggards are quickly cast aside to the B-list or worse. That’s the message coming across from a new report saying Hollywood movies are taking a growing piece of the Chinese movie market since Beijing started allowing more US films into the market earlier this year. It’s also the message that Chinese firms are likely to learn the hard way as they try to buy into the Hollywood scene, as one Beijing company will probably learn after last week signing a deal to invest in a big-budget US film.

China Telecom Jumps Into 4G Race 中国电信加入4G争夺战

With signs growing by the day that China will issue 4G licenses quite soon, perhaps by March next year, the nation’s second and third largest carriers are sensing a sudden urgency to get ready for the roll-out and avoid a possible booby prize that either could easily receive. The 2 telcos I’m talking about of course are China Telecom (HKEx: 728; NYSE: CHA) and China Unicom (HKEx: 762; NYSE: CHU), both of which have suddenly begun trialing 4G technology in anticipation of the imminent issue of 4G licenses.

With signs growing by the day that China will issue 4G licenses quite soon, perhaps by March next year, the nation’s second and third largest carriers are sensing a sudden urgency to get ready for the roll-out and avoid a possible booby prize that either could easily receive. The 2 telcos I’m talking about of course are China Telecom (HKEx: 728; NYSE: CHA) and China Unicom (HKEx: 762; NYSE: CHU), both of which have suddenly begun trialing 4G technology in anticipation of the imminent issue of 4G licenses.

Beijing EV Campaign Targets Mass Buyers 中国电动汽车激励措施瞄准大宗购买者

Struggling electric vehicle (EV) maker BYD (HKEx: 1211; Shenzhen: 002594) got a major boost last week when Beijing announced an innovative new plan to stimulate an anemic industry whose sales have failed to take off despite generous government support. The plan this time around looks much smarter than previous ones by focusing on big customers.

Struggling electric vehicle (EV) maker BYD (HKEx: 1211; Shenzhen: 002594) got a major boost last week when Beijing announced an innovative new plan to stimulate an anemic industry whose sales have failed to take off despite generous government support. The plan this time around looks much smarter than previous ones by focusing on big customers.

News Digest: November 10-12 报摘: 2012年11月10-12日

The following press releases and media reports about Chinese companies were carried on Nov 10-12. To view a full article or story, click on the link next to the headline.

══════════════════════════════════════════════════════

- China Telecom (HKEx: 728) Tests FDD-LTE Network in Guangzhou – Source (English article)

- BYD (HKEx: 1211), China Dev Bank Offer Financing for Public Transport EVs (Businesswire)

- Signs Point to Imminent Release of Amazon’s (Nasdaq: AMZN) Kindle in China (Chinese article)

- HiSoft (Nasdaq: HSFT), VanceInfo (NYSE: VIT) Announce Completion of Merger (PRNewswire)

- Hollywood Magic Put to Work in China With “Enders Game” Participation Deal (English article)

- Latest calendar for Q3 earnings reports (Earnings calendar)