Journalist China

Huawei Takes Refuge in India 华为在印度寻找避风港

Telecoms equipment giant Huawei, facing hostility on nearly ever major front in the West, is turning to India as it looks for a friendly face, with the announcement that it will spend some $2 billion on a new global product development center in this neighboring BRICS country. As a longtime Huawei watcher, I find this latest move somewhat ironic, as India was actually one of the first countries to launch an investigation due to security concerns into Huawei and crosstown rival ZTE (HKEx: 763; Shenzhen: 000063).

Telecoms equipment giant Huawei, facing hostility on nearly ever major front in the West, is turning to India as it looks for a friendly face, with the announcement that it will spend some $2 billion on a new global product development center in this neighboring BRICS country. As a longtime Huawei watcher, I find this latest move somewhat ironic, as India was actually one of the first countries to launch an investigation due to security concerns into Huawei and crosstown rival ZTE (HKEx: 763; Shenzhen: 000063).

Ad Slowdown Builds With Publicis Warning 阳狮预警反映中国广告市场增长加速下滑

French publishing giant Publicis (Paris: PUBP) has become the latest media firm to warn of an advertising slowdown in China, setting the stage for some ugly numbers when new media companies start reporting their second-quarter results next month. The slowdown has already started to hit second-tier players like Phoenix New Media (NYSE: FENG) and social networking site Renren (NYSE: RENN), and has even shown signs of starting to affect top tier players like leading web portal Sina (Nasdaq: SINA). (previous post)

French publishing giant Publicis (Paris: PUBP) has become the latest media firm to warn of an advertising slowdown in China, setting the stage for some ugly numbers when new media companies start reporting their second-quarter results next month. The slowdown has already started to hit second-tier players like Phoenix New Media (NYSE: FENG) and social networking site Renren (NYSE: RENN), and has even shown signs of starting to affect top tier players like leading web portal Sina (Nasdaq: SINA). (previous post)

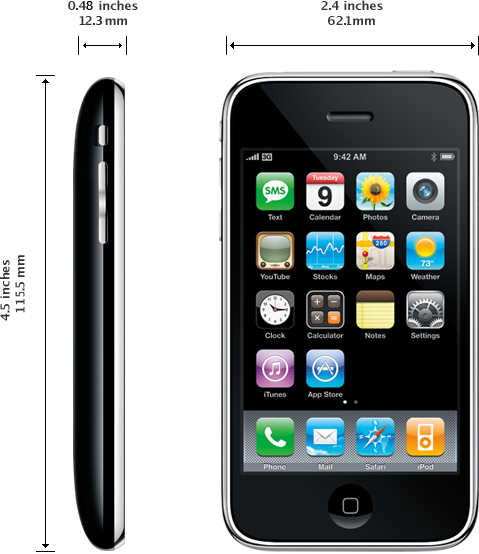

Qualcomm Key on China Mobile iPhone Deal 中国移动能否引进iPhone关键要看高通

Wireless giant China Mobile (HKEx: 941; NYSE: CHL) is sending out some interesting new signals that look like positive developments in its stalled iPhone deal with Apple (Nasdaq: AAPL), as well as its drive to develop its e-commerce business. Let’s look at the iPhone development first, as it’s the one with the most potential to give a much-needed boost to China Mobile and its poorly performing 3G network, which has suffered from technical problems and also lackluster promotion by China Mobile itself.

Wireless giant China Mobile (HKEx: 941; NYSE: CHL) is sending out some interesting new signals that look like positive developments in its stalled iPhone deal with Apple (Nasdaq: AAPL), as well as its drive to develop its e-commerce business. Let’s look at the iPhone development first, as it’s the one with the most potential to give a much-needed boost to China Mobile and its poorly performing 3G network, which has suffered from technical problems and also lackluster promotion by China Mobile itself.

Short Sellers Attack Lenovo, Evergrande 联想和恒大地产遭卖空狙击

It’s summertime and that means the short selling sharks have come out in search of new prey, making fresh attacks on PC giant Lenovo (HKEx: 992) and real estate braggart Evergrande (HKEx: 3333) in a bid to capitalize on lingering investor doubts about Chinese companies’ accounting practices. Both companies saw their shares tumble late last week after negative reports came out, with Lenovo shares shedding 11 percent while Evergrande fell as much as 18 percent.

It’s summertime and that means the short selling sharks have come out in search of new prey, making fresh attacks on PC giant Lenovo (HKEx: 992) and real estate braggart Evergrande (HKEx: 3333) in a bid to capitalize on lingering investor doubts about Chinese companies’ accounting practices. Both companies saw their shares tumble late last week after negative reports came out, with Lenovo shares shedding 11 percent while Evergrande fell as much as 18 percent.

Huawei Set For Europe Smartphone Blitz 华为智能手机全球营销首选欧洲

Telecoms equipment giant Huawei may be a familiar name to industry insiders, but as a consumer brand it has a long way to go as it tries to develop its consumer-oriented smartphone business. In pursuit of that aim, the company is gearing up for a massive marketing blitz that looks set to target the lucrative European market first, to be followed perhaps by an eventual try at the more difficult US market. The choice of Europe for its first global smartphone offensive looks smart, mirroring a similar path for the rise to prominence of Huawei’s core networking equipment business staring in the mid 2000s.

Telecoms equipment giant Huawei may be a familiar name to industry insiders, but as a consumer brand it has a long way to go as it tries to develop its consumer-oriented smartphone business. In pursuit of that aim, the company is gearing up for a massive marketing blitz that looks set to target the lucrative European market first, to be followed perhaps by an eventual try at the more difficult US market. The choice of Europe for its first global smartphone offensive looks smart, mirroring a similar path for the rise to prominence of Huawei’s core networking equipment business staring in the mid 2000s.

FTuan-Gaopeng Merger Looms, LaShou Next? F团与高朋网合并接近完成 拉手网或成下一个目标

A day after leading group buying site LaShou formally scrapped its New York IPO (previous post), there’s an interesting detailed report out about the ongoing merger between 2 group buying sites backed by Tencent (HKEx: 700), China top Internet company. But what’s more interesting to me than the actual report of this ongoing merger is the potential for the cash-rich Tencent itself to emerge as a key consolidator in the ongoing clean-up of the unruly group buying space, perhaps even making a play for LaShou itself as that company struggles for survival.

A day after leading group buying site LaShou formally scrapped its New York IPO (previous post), there’s an interesting detailed report out about the ongoing merger between 2 group buying sites backed by Tencent (HKEx: 700), China top Internet company. But what’s more interesting to me than the actual report of this ongoing merger is the potential for the cash-rich Tencent itself to emerge as a key consolidator in the ongoing clean-up of the unruly group buying space, perhaps even making a play for LaShou itself as that company struggles for survival.

China Mobile Moves Ahead on 4G, Broadband 中国移动提前推进4G、宽带业务

China Mobile (HKEx: 941; NYSE: CHL), the nation’s largest mobile carrier, is forging ahead with a couple of new initiatives in the broadband and 4G spaces, even as it neglects its 3G mobile business that continues to lose market share. I’m happy to see that the company seems determined to move ahead with broadband, which could become an important new revenue source. But I worry that the telecoms regulator will soon clamp down on China Mobile’s aggressive 4G drive that is increasingly looking like an unlicensed commercial service.

China Mobile (HKEx: 941; NYSE: CHL), the nation’s largest mobile carrier, is forging ahead with a couple of new initiatives in the broadband and 4G spaces, even as it neglects its 3G mobile business that continues to lose market share. I’m happy to see that the company seems determined to move ahead with broadband, which could become an important new revenue source. But I worry that the telecoms regulator will soon clamp down on China Mobile’s aggressive 4G drive that is increasingly looking like an unlicensed commercial service.

China Throws More Money at Sputtering EVs 对购买新能源汽车进行补贴是徒劳的

Despite the growing sounds of failure for its ambitious drive to develop alternate energy vehicles, Beijing is preparing to throw still more money at this foundering sector, resorting to its same tired old approach for that never seems to work for developing new industries. More than a year after announcing an initial package of wide-ranging incentives to boost electric and hybrid vehicle sales, Beijing is preparing to launch yet another round of new incentives aimed at getting more consumers to buy these cars, according to Chinese media reports. (English article)

Despite the growing sounds of failure for its ambitious drive to develop alternate energy vehicles, Beijing is preparing to throw still more money at this foundering sector, resorting to its same tired old approach for that never seems to work for developing new industries. More than a year after announcing an initial package of wide-ranging incentives to boost electric and hybrid vehicle sales, Beijing is preparing to launch yet another round of new incentives aimed at getting more consumers to buy these cars, according to Chinese media reports. (English article)

ZTE Commits to US, Huawei Hesitates 中兴“死磕”美国市场 华为略有收手

We’re seeing some interesting new signs coming from troubled telecoms equipment giants ZTE (HKEx: 763; NYSE: 000063) and Huawei in the US, with the former reaffirming its commitment to the difficult market even as the latter reportedly scales back its presence there. These latest signals reflect not only the many obstacles that both companies have faced in the US lately, but also challenges they are seeing in many western markets where governments worry that the pair are simply spying arms of Beijing.

Jingdong Mall, LaShou: Turmoil in Cyberspace 京东商城、拉手网:互联网领域混乱

The latest signs of trouble in China’s overheated Internet sector are bubbling into the headlines again, with word that group discount leader LaShou has scrapped its troubled IPO while another high level executive has resigned from e-commerce giant Jingdong Mall, also known as 360Buy. Both developments have some company-specific issues behind them, but more broadly speaking they also reflect an overheated China Internet that has seen internal turbulence grow at many companies as they struggle for dominance and simply survival.

The latest signs of trouble in China’s overheated Internet sector are bubbling into the headlines again, with word that group discount leader LaShou has scrapped its troubled IPO while another high level executive has resigned from e-commerce giant Jingdong Mall, also known as 360Buy. Both developments have some company-specific issues behind them, but more broadly speaking they also reflect an overheated China Internet that has seen internal turbulence grow at many companies as they struggle for dominance and simply survival.