Just a day after I wrote about the latest mixed signals coming from China Mobile (HKEx: 941; NYSE: CHL), we’re getting still more mixed messages from China’s largest wireless telco, including an exciting one that indicates a highly anticipated new tie-up with Apple (Nasdaq: AAPL) could come soon. While the Apple tie-up would be highly welcome, another unrelated development appears to indicate that a deal that would have seen China Mobile link up with China’s new national cable TV operator may fail to materialize.

Tag Archives: Qualcomm

News Digest: August 8, 2012 报摘: 2012年8月8日

The following press releases and media reports about Chinese companies were carried on August 8. To view a full article or story, click on the link next to the headline.

══════════════════════════════════════════════════════

- Qualcomm (Nasdaq: QCOM) to Release TD-SCDMA Chips in H2 2012 (English article)

- Finance Ministry Provides Billions of Yuan for New National Cable TV Operator (Chinese article)

- Citigroup (NYSE: C) Plans to Double Outlets in China in 3 Years: Executive (English article)

- Ctrip (Nasdaq: CTRP) and Booking.com Forge Global Travel Partnership (PRNewswire)

- Youku (NYSE: YOKU), Tudou to Close Merger By Month-End – Youku Exec (Chinese article)

- Latest calendar for Q2 earnings reports (Earnings calendar)

Qualcomm Key on China Mobile iPhone Deal 中国移动能否引进iPhone关键要看高通

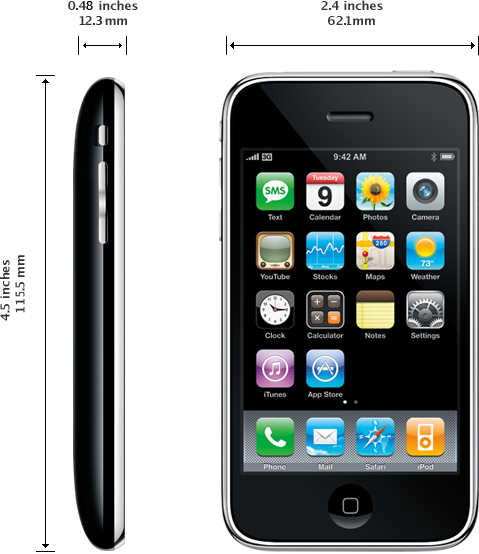

Wireless giant China Mobile (HKEx: 941; NYSE: CHL) is sending out some interesting new signals that look like positive developments in its stalled iPhone deal with Apple (Nasdaq: AAPL), as well as its drive to develop its e-commerce business. Let’s look at the iPhone development first, as it’s the one with the most potential to give a much-needed boost to China Mobile and its poorly performing 3G network, which has suffered from technical problems and also lackluster promotion by China Mobile itself.

Wireless giant China Mobile (HKEx: 941; NYSE: CHL) is sending out some interesting new signals that look like positive developments in its stalled iPhone deal with Apple (Nasdaq: AAPL), as well as its drive to develop its e-commerce business. Let’s look at the iPhone development first, as it’s the one with the most potential to give a much-needed boost to China Mobile and its poorly performing 3G network, which has suffered from technical problems and also lackluster promotion by China Mobile itself.

ZTE Commits to US, Huawei Hesitates 中兴“死磕”美国市场 华为略有收手

We’re seeing some interesting new signs coming from troubled telecoms equipment giants ZTE (HKEx: 763; NYSE: 000063) and Huawei in the US, with the former reaffirming its commitment to the difficult market even as the latter reportedly scales back its presence there. These latest signals reflect not only the many obstacles that both companies have faced in the US lately, but also challenges they are seeing in many western markets where governments worry that the pair are simply spying arms of Beijing.

Russia’s DST Builds More Valuation Froth 俄罗斯DST助长中国互联网企业估值虚高

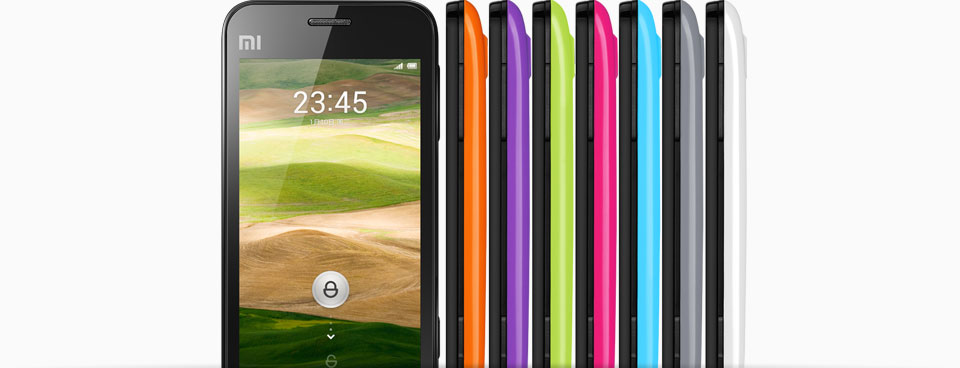

When historians write about the China Internet bubble of 2011-2012 years from now, they are likely to feature Russia’s Digital Sky Technologies (DST) as perhaps the biggest foreign force that pumped in big sums of money and drove up valuations to unsustainable levels. The company, which rose to prominence as an early investor in Facebook (Nasdaq: FB), has been a steady investor in Chinese Internet companies, and is now making headlines yet again with another reported purchase of a stake in Xiaomi, an up-and-coming maker of low-cost, high-performance smartphones. (Chinese article) The Chinese headlines are buzzing with news of this major new investment in Xiaomi, including an interesting twist that saw Internet giant Tencent (HKEx: 700) withdraw from the new investor group after Xiaomi refused to shutter one of its services that competed with Tencent’s Weixin instant messaging service. But I’m digressing from the main subject of this posting, which is that DST has become a major force behind China’s Internet bubble, repeatedly making big new investments that drive up valuations for some interesting start-ups — many of them money-losing companies — to overinflated levels. In a similar pattern seen in DST’s previous investments, unnamed sources in this instance are saying this new capital raising values Xiaomi at around $4 billion — a number that puts it in the same ranks as much older names like Sina (Nasdaq: SINA) and NetEase (Nasdaq: NTES) that have much longer operating histories. I have little doubt that the unnamed sources in this case are inside DST, as similar unnamed sources have also flouted sky-high valuations after DST made other recent investments in e-commerce leaders Alibaba (previous post) and Jingdong Mall, which also goes by the name 360Buy. (previous post) I wrote about Xiaomi earlier this year, as it really does look like an interesting company that is full of market potential due to its niche as maker of low-cost, high-performance smartphones that sell for around $300 each. (previous post) The company previously raised around $90 million in new funding last year, and counts such big names as Singapore’s Temasek, leading chipmaker Qualcomm (Nasdaq: QCOM) and tech investment specialist IDG among its earlier investors. Furthermore, its CEO disclosed late last year that it sold nearly 400,000 of its first smartphone in 2011, and hinted its major new customers could include China Unicom (HKEx: 762; NYSE: CHU), China’s second largest wireless carrier. This kind of early progress is certainly encouraging, though I sincerely believe that DST isn’t doing Xiaomi or any of its other investments any favors by giving them more money than they probably need and filling the market with such high valuations. I’ve previously said that China’s overheated Internet space is in the midst of a much needed correction, which is already starting to see valuations for many companies come down. By the time the bubble finally finishes bursting, look for valuations of many of DST’s investments, and Internet companies in general, to be quite a bit lower than figures now in the market, more in line with peers from the US and Europe.

When historians write about the China Internet bubble of 2011-2012 years from now, they are likely to feature Russia’s Digital Sky Technologies (DST) as perhaps the biggest foreign force that pumped in big sums of money and drove up valuations to unsustainable levels. The company, which rose to prominence as an early investor in Facebook (Nasdaq: FB), has been a steady investor in Chinese Internet companies, and is now making headlines yet again with another reported purchase of a stake in Xiaomi, an up-and-coming maker of low-cost, high-performance smartphones. (Chinese article) The Chinese headlines are buzzing with news of this major new investment in Xiaomi, including an interesting twist that saw Internet giant Tencent (HKEx: 700) withdraw from the new investor group after Xiaomi refused to shutter one of its services that competed with Tencent’s Weixin instant messaging service. But I’m digressing from the main subject of this posting, which is that DST has become a major force behind China’s Internet bubble, repeatedly making big new investments that drive up valuations for some interesting start-ups — many of them money-losing companies — to overinflated levels. In a similar pattern seen in DST’s previous investments, unnamed sources in this instance are saying this new capital raising values Xiaomi at around $4 billion — a number that puts it in the same ranks as much older names like Sina (Nasdaq: SINA) and NetEase (Nasdaq: NTES) that have much longer operating histories. I have little doubt that the unnamed sources in this case are inside DST, as similar unnamed sources have also flouted sky-high valuations after DST made other recent investments in e-commerce leaders Alibaba (previous post) and Jingdong Mall, which also goes by the name 360Buy. (previous post) I wrote about Xiaomi earlier this year, as it really does look like an interesting company that is full of market potential due to its niche as maker of low-cost, high-performance smartphones that sell for around $300 each. (previous post) The company previously raised around $90 million in new funding last year, and counts such big names as Singapore’s Temasek, leading chipmaker Qualcomm (Nasdaq: QCOM) and tech investment specialist IDG among its earlier investors. Furthermore, its CEO disclosed late last year that it sold nearly 400,000 of its first smartphone in 2011, and hinted its major new customers could include China Unicom (HKEx: 762; NYSE: CHU), China’s second largest wireless carrier. This kind of early progress is certainly encouraging, though I sincerely believe that DST isn’t doing Xiaomi or any of its other investments any favors by giving them more money than they probably need and filling the market with such high valuations. I’ve previously said that China’s overheated Internet space is in the midst of a much needed correction, which is already starting to see valuations for many companies come down. By the time the bubble finally finishes bursting, look for valuations of many of DST’s investments, and Internet companies in general, to be quite a bit lower than figures now in the market, more in line with peers from the US and Europe.

Bottom line: Russia’s Digital Sky is adding to China’s Internet bubble by investing in companies at inflated valuations, which will come down sharply by the time a current correction ends.

Related postings 相关文章:

◙ Xiaomi: A Fresh Face In Smartphones 小米:智能手机新面孔

◙ More Internet Froth in Alibaba Valuation, Dangdang Price War 阿里巴巴估值奇高凸显网络泡沫

◙ 360Buy — More Details But Still Pricey 京东商城值多少?

Lenovo’s TV Gamble: Failure Ahead? 联想电视赌注:未来会失败吗?

I should credit leading PC maker Lenovo (HKEx: 992) for being ahead of the curve by releasing its new smart TV in China last week, getting a slight lead on a widely anticipated launch for by Apple (Nasdaq: AAPL) for a similar new product group that could revolutionize the way people watch TV. (English article) Reviews are still few for Lenovo’s new product, a 55-inch TV called the K91; but based on its past track record as a company with limited capability in new product design, I would offer only a very small chance for this product to succeed, potentially costing Lenovo hundreds of millions of dollars in development and marketing costs. The reason for my pessimism is simple: Lenovo, a specialist in PCs for developing markets, has never shown any ability to be a leader in new product design, especially in areas where it has little or no experience. Its previous forays into cellphones, gaming consoles and tablet PCs have all been mostly flops, failing to generate any buzz or excitement after having to compete with better designed products from the likes of more innovative firms like Apple, Samsung (Seoul: 005930), Asustek (Taipei: 2357) and HTC (HKEx: 2498). Given that poor track record, I have little reason to believe this latest initiative will succeed either, especially since such smart TVs are a completely new category and thus there are few products out there to use as a guidebook into what works and what doesn’t for this area. I do at least have to give Lenovo credit for trying hard by buying state-of-the art technology for its first smart TV, with components coming from such top-end suppliers as chip designer Qualcomm (Nasdaq: QCOM), audio technology firm DTS (Nasdaq: DTSI) and its operating system based on Google’s (Nasdaq: GOOG) popular Android platform. The company may also be making a smart choice by launching the product in its home China market, where it is the dominant PC brand and which accounts for around half of its sales. But its early launch even in China could mean very little if its product doesn’t contain content and functionality that ordinary consumers want. What’s more, competing products from Samsung and especially Apple are likely to hit the market in a matter of months, meaning Lenovo won’t have much of a head-start over these rivals whose products will no doubt contain more features and generate more buzz than the Lenovo TVs. Lenovo hasn’t said very much about response for the product in the week since its launch, saying only that performance has exceeded its expectations. (Chinese article) But considering its past track record, look for the K91 to post disappointing sales over the longer term, perhaps in the tens of thousands this year, and for this broader smart TV initiative to end up as a failure for Lenovo like many of its other new product initiatives.

Bottom line: Lenovo’s new smart TV initiative is likely to fail despite an early head-start over rivals in China, with products from foreign rivals likely to eventually dominate the market.

Related postings 相关文章:

◙ NEC China Cellphones: New Lenovo Tie-Up? NEC计划重回中国手机市场 或与联想联姻

◙ Lenovo Completes Leadership Change, Yang Uninspired 联想完成高层调整,杨元庆难鼓舞人心

◙ Apple Feasts on China, Baidu Burps 苹果在华享受盛宴,百度盛宴停顿

Bottom line:

News Digest: February 21, 2012 报摘: 2012年2月21日

The following press releases and media reports about Chinese companies were carried on February 21. To view a full article or story, click on the link next to the headline.

══════════════════════════════════════════════════════

◙ ZTE (HKEx: 763) Announces $4 Bln Chipset Agreement With Qualcomm (Nasdaq: QCOM) (HKEx announcement)

◙ Ctrip (Nasdaq: CTRP) Reports Q4 and Full Year Results (PRNewswire)

◙ Shenzhen Court Rejects Apple’s (Nasdaq: AAPL) E-Mail Evidence (English article)

◙ China’s TD-LTE Trials Enter Phase II (English article)

◙ 360Buy Formally Launches E-Book Site, To Later Add Digital Music (Chinese article)

◙ Latest calendar for Q1 earnings reports (Earnings calendar)

News Digest: January 19, 2012

The following press releases and media reports about Chinese companies were carried on January 19. To view a full article or story, click on the link next to the headline.

══════════════════════════════════════════════════════

◙ China Said to Let Biggest Banks Boost Lending This Quarter to Spur Growth (English article)

◙ American Express (NYSE: AXP) Partners with Chinese Mobile Top-Up Provider Lianlian (Businesswire)

◙ CNOOC (HKEx: 883) Announces Its 2012 Business Strategy and Development Plan (PRNewswire)

◙ China Accounts for 32% of Qualcomm (Nasdaq: QCOM) Revenue (English article)

◙ Alibaba, Yahoo (Nasdaq: YHOO) Talks Advance, Buyout Possible By Mid-Feb – Report (Chinese article)

Lenovo: Finally a Risk Taker In Intel Tie-Up 联想联手英特尔,终於肯冒险

I have to applaud Chinese PC maker Lenovo (HKEx: 992) for its decision to be one of the first backers for a new smartphone chip developed by Intel (Nasdaq: INTC), not so much because I believe this new product will succeed but more because it shows Lenovo is finally starting to shed its image as a follower and take some intelligent risks. This is exactly the kind of thing the company needs to do more if it wants to become a true global leader, even though such risks are likely to produce some big failures, and this one is no exception. Let’s look more closely at this move, which Lenovo announced at the massive Consumer Electronics Show this week in Las Vegas. Lenovo, along with Motorola Mobility (NYSE: MMI), announced they will be the first partners to use a new chip that Intel has developed for smartphones and tablet PCs that are stealing share from the chipmaker’s traditional PC business. (English article) The current smartphone market is dominated by chipmaker ARM (London: ARM), working with companies like Qualcomm (Nasdaq: QCOM) and Broadcom (Nasdaq: BRCM). Intel has never been able to break into the market, but realizes it must do so or risk watching its PC chip business shrivel as more people use tablets and smartphones for their computing. Lenovo, which already makes smartphones but hasn’t found much success in the area, is taking what looks like a smart risk here by signing up as one of the first customers for Intel’s new chip. By making this move, it will immediately have access to Intel’s huge resources to help it develop new smartphones that could differentiate themselves in areas like computing speed and energy consumption from similar ARM-based products. And as one of Intel’s first customers, it will also receive goodwill from the US chip giant that it can use for future collaboration. On the downside, Intel has a spotty record for developing chips outside is core PC business, and in this case it is already far behind existing products. I would ultimately give this initiative less than a 50 percent chance of success, but still must congratulate Lenovo for trying to shed its image as follower and finally become a leader in new product development.

I have to applaud Chinese PC maker Lenovo (HKEx: 992) for its decision to be one of the first backers for a new smartphone chip developed by Intel (Nasdaq: INTC), not so much because I believe this new product will succeed but more because it shows Lenovo is finally starting to shed its image as a follower and take some intelligent risks. This is exactly the kind of thing the company needs to do more if it wants to become a true global leader, even though such risks are likely to produce some big failures, and this one is no exception. Let’s look more closely at this move, which Lenovo announced at the massive Consumer Electronics Show this week in Las Vegas. Lenovo, along with Motorola Mobility (NYSE: MMI), announced they will be the first partners to use a new chip that Intel has developed for smartphones and tablet PCs that are stealing share from the chipmaker’s traditional PC business. (English article) The current smartphone market is dominated by chipmaker ARM (London: ARM), working with companies like Qualcomm (Nasdaq: QCOM) and Broadcom (Nasdaq: BRCM). Intel has never been able to break into the market, but realizes it must do so or risk watching its PC chip business shrivel as more people use tablets and smartphones for their computing. Lenovo, which already makes smartphones but hasn’t found much success in the area, is taking what looks like a smart risk here by signing up as one of the first customers for Intel’s new chip. By making this move, it will immediately have access to Intel’s huge resources to help it develop new smartphones that could differentiate themselves in areas like computing speed and energy consumption from similar ARM-based products. And as one of Intel’s first customers, it will also receive goodwill from the US chip giant that it can use for future collaboration. On the downside, Intel has a spotty record for developing chips outside is core PC business, and in this case it is already far behind existing products. I would ultimately give this initiative less than a 50 percent chance of success, but still must congratulate Lenovo for trying to shed its image as follower and finally become a leader in new product development.

Bottom line: Lenovo’s new smartphone partnership with Intel is likely to fail in the long run, but still reflects the company’s aim to become a leader in new product development.

Related postings 相关文章:

◙ Lenovo Starts Year With New Europe Chief, TV Tie-Up 联想新年新气象:聘用新高管并推互联网电视

Xiaomi: A Fresh Face In Smartphones 小米:智能手机新面孔

A start-up smartphone maker named Xiaomi has been bubbling up regularly in the headlines since launching its inaugural low-cost, high-performance Android smartphone in August, but what finally caught my attention were some numbers that look impressive in terms of both investment and sales. The company, clearly looking to inject some buzz into its flagship product, held a press conference this week, where CEO Lei Jun told the world that Xiaomi has sold nearly 400,000 of its MI-ONE phones so far, and hinted that China Unicom (HKEx: 762), the country’s second biggest mobile carrier, has placed orders for more than 1 million more. (Chinese article) The MI-ONE looks interesting for a number of reasons, including its relatively low price of around $300 for what reviewers are saying is a very high performance smartphone that can finally take advantage of Unicom’s 3G service, China’s fastest network which is also highly underutilized due to numerous internal problems at the carrier. (previous post) Xiaomi is also taking the interesting tack of using its product to try and build up its Miliao mobile instant messaging service, which the company says now has more than 1 million active users and could be a future revenue source. The company’s prospects have attracted some big names, with big names, with IDG, Temasek and Qualcomm (Nasdaq: QCOM) all among an investor group that recently handed Xiaomi, whose name means “little rice” in Chinese, a hearty $90 million in new funding. Clearly Xiaomi has some strong momentum behind it, though the Unicom deal will be crucial as it will show whether Chinese consumers like this product, which in turn could lead to big overseas orders for consumers looking for lower cost alternatives to popular models from Apple (Nasdaq: AAPL), HTC (Taipei: 2498) and others. Xiaomi will still have a tough road ahead, as Unicom is also preparing to roll out Apple’s popular iPhone 4S in January, and is selling many other 3G models as well in a bid to try to gain some momentum in the domestic 3G market. Xiaomi will most likely need another big funding round soon, as its position as a cellphone maker means it will have to spend big bucks on both manufacturing and new product development. But the signs do look promising, at least initially, and if the Unicom partnership goes well this could clearly be a company to watch for an IPO as soon as late next year.

A start-up smartphone maker named Xiaomi has been bubbling up regularly in the headlines since launching its inaugural low-cost, high-performance Android smartphone in August, but what finally caught my attention were some numbers that look impressive in terms of both investment and sales. The company, clearly looking to inject some buzz into its flagship product, held a press conference this week, where CEO Lei Jun told the world that Xiaomi has sold nearly 400,000 of its MI-ONE phones so far, and hinted that China Unicom (HKEx: 762), the country’s second biggest mobile carrier, has placed orders for more than 1 million more. (Chinese article) The MI-ONE looks interesting for a number of reasons, including its relatively low price of around $300 for what reviewers are saying is a very high performance smartphone that can finally take advantage of Unicom’s 3G service, China’s fastest network which is also highly underutilized due to numerous internal problems at the carrier. (previous post) Xiaomi is also taking the interesting tack of using its product to try and build up its Miliao mobile instant messaging service, which the company says now has more than 1 million active users and could be a future revenue source. The company’s prospects have attracted some big names, with big names, with IDG, Temasek and Qualcomm (Nasdaq: QCOM) all among an investor group that recently handed Xiaomi, whose name means “little rice” in Chinese, a hearty $90 million in new funding. Clearly Xiaomi has some strong momentum behind it, though the Unicom deal will be crucial as it will show whether Chinese consumers like this product, which in turn could lead to big overseas orders for consumers looking for lower cost alternatives to popular models from Apple (Nasdaq: AAPL), HTC (Taipei: 2498) and others. Xiaomi will still have a tough road ahead, as Unicom is also preparing to roll out Apple’s popular iPhone 4S in January, and is selling many other 3G models as well in a bid to try to gain some momentum in the domestic 3G market. Xiaomi will most likely need another big funding round soon, as its position as a cellphone maker means it will have to spend big bucks on both manufacturing and new product development. But the signs do look promising, at least initially, and if the Unicom partnership goes well this could clearly be a company to watch for an IPO as soon as late next year.

Bottom line: Xiaomi has good potential as a niche maker of relatively low-cost, high-performance smartphones, and will get its first real test from a new partnership with Unicom.

Related postings 相关文章:

◙ Unicom’s Sputtering 3G: Blame It On the Handsets 联通幡然醒悟 借低价手机扩张3G市场

◙ Unicom, China Telecom in iPhone 4S 中国电信有望领先推出iPhone 4S Race

◙ ZTE Faces More Profit Erosion With Latest Low-Cost Moves 中兴通讯以低价机抢占市场恐损及获利

Spreadtrum, Mediatek in Cheap Smartphone Plays

Two chip designers, Taiwan’s MediaTek (Taipei: 2454) and China’s own Spreadtrum (Nasdaq: SPRD) are looking like interesting bets these days, as they seek to profit from burgeoning demand for cheap smartphones in emerging markets like China and India where carriers are trying to boost recently built 3G networks. In fact, MediaTek has always been a specialist at cheap cellphone chips, allowing it to play at the low end of a market otherwise dominated by the likes of Qualcomm (Nasdaq: QCOM) and Texas Instruments (NYSE: TXN). It entered the smartphone market with an Android-based chip earlier this year, and, after landing supply deals with names like Lenovo (HKEx: 992) and ZTE (HKEx: 763; Shenzhen: 000063) is reportedly in talks for another big deal that could see it supply Huawei, another leading cheap smartphone maker. (English article) Meantime, Spreadtrum is making its own interesting cheap smartphone play, focusing on the very limited market making chips for the homegrown Chinese 3G standard known as TD-SCDMA, whose only major proponent is China Mobile (HKEx: 941; NYSE: CHL). Spreadtrum has just announced its launch of an ultra-cheap chipset that will allow handset manufacturers to make TD-SCDMA smartphones for as little as $40 each, meaning such phones could easily retail below the $100 mark considered a key threshold for cost-conscious middle- to lower-end users. (company announcement) A lack of compelling handsets has been a major factor hindering China Mobile’s efforts to build up its 3G business to date. (previous post) The availability of a wide range of ultra-low-cost TD-SCDMA phones, assuming Spreadtrum can find customers for its new chips, could be just the catalyst that China Mobile needs to breath some new life into its 3G network. Equally important for Spreadtrum, its development of a TD-SCDMA smartphone chip seems to indicate it is also dedicated to the standard’s 4G successor, TD-LTE, which could put it in a strong position to be a big supplier in chips for that standard which is already being tested out in China and a number of other major markets, including Japan and India.

Two chip designers, Taiwan’s MediaTek (Taipei: 2454) and China’s own Spreadtrum (Nasdaq: SPRD) are looking like interesting bets these days, as they seek to profit from burgeoning demand for cheap smartphones in emerging markets like China and India where carriers are trying to boost recently built 3G networks. In fact, MediaTek has always been a specialist at cheap cellphone chips, allowing it to play at the low end of a market otherwise dominated by the likes of Qualcomm (Nasdaq: QCOM) and Texas Instruments (NYSE: TXN). It entered the smartphone market with an Android-based chip earlier this year, and, after landing supply deals with names like Lenovo (HKEx: 992) and ZTE (HKEx: 763; Shenzhen: 000063) is reportedly in talks for another big deal that could see it supply Huawei, another leading cheap smartphone maker. (English article) Meantime, Spreadtrum is making its own interesting cheap smartphone play, focusing on the very limited market making chips for the homegrown Chinese 3G standard known as TD-SCDMA, whose only major proponent is China Mobile (HKEx: 941; NYSE: CHL). Spreadtrum has just announced its launch of an ultra-cheap chipset that will allow handset manufacturers to make TD-SCDMA smartphones for as little as $40 each, meaning such phones could easily retail below the $100 mark considered a key threshold for cost-conscious middle- to lower-end users. (company announcement) A lack of compelling handsets has been a major factor hindering China Mobile’s efforts to build up its 3G business to date. (previous post) The availability of a wide range of ultra-low-cost TD-SCDMA phones, assuming Spreadtrum can find customers for its new chips, could be just the catalyst that China Mobile needs to breath some new life into its 3G network. Equally important for Spreadtrum, its development of a TD-SCDMA smartphone chip seems to indicate it is also dedicated to the standard’s 4G successor, TD-LTE, which could put it in a strong position to be a big supplier in chips for that standard which is already being tested out in China and a number of other major markets, including Japan and India.

Bottom line: MediaTek and Spreadtrum are looking like strong bets in the cheap smartphone chip market, which should see strong demand from 3G and 4G consumers in emerging markets.

Related postings 相关文章:

◙ Spreadtrum Takes Smart Gamble on China 3G

◙ China Mobile: Poor 3G Approach Yields Weak Results 中移动3G策略不当 拖累公司三季度业绩