When historians write about the China Internet bubble of 2011-2012 years from now, they are likely to feature Russia’s Digital Sky Technologies (DST) as perhaps the biggest foreign force that pumped in big sums of money and drove up valuations to unsustainable levels. The company, which rose to prominence as an early investor in Facebook (Nasdaq: FB), has been a steady investor in Chinese Internet companies, and is now making headlines yet again with another reported purchase of a stake in Xiaomi, an up-and-coming maker of low-cost, high-performance smartphones. (Chinese article) The Chinese headlines are buzzing with news of this major new investment in Xiaomi, including an interesting twist that saw Internet giant Tencent (HKEx: 700) withdraw from the new investor group after Xiaomi refused to shutter one of its services that competed with Tencent’s Weixin instant messaging service. But I’m digressing from the main subject of this posting, which is that DST has become a major force behind China’s Internet bubble, repeatedly making big new investments that drive up valuations for some interesting start-ups — many of them money-losing companies — to overinflated levels. In a similar pattern seen in DST’s previous investments, unnamed sources in this instance are saying this new capital raising values Xiaomi at around $4 billion — a number that puts it in the same ranks as much older names like Sina (Nasdaq: SINA) and NetEase (Nasdaq: NTES) that have much longer operating histories. I have little doubt that the unnamed sources in this case are inside DST, as similar unnamed sources have also flouted sky-high valuations after DST made other recent investments in e-commerce leaders Alibaba (previous post) and Jingdong Mall, which also goes by the name 360Buy. (previous post) I wrote about Xiaomi earlier this year, as it really does look like an interesting company that is full of market potential due to its niche as maker of low-cost, high-performance smartphones that sell for around $300 each. (previous post) The company previously raised around $90 million in new funding last year, and counts such big names as Singapore’s Temasek, leading chipmaker Qualcomm (Nasdaq: QCOM) and tech investment specialist IDG among its earlier investors. Furthermore, its CEO disclosed late last year that it sold nearly 400,000 of its first smartphone in 2011, and hinted its major new customers could include China Unicom (HKEx: 762; NYSE: CHU), China’s second largest wireless carrier. This kind of early progress is certainly encouraging, though I sincerely believe that DST isn’t doing Xiaomi or any of its other investments any favors by giving them more money than they probably need and filling the market with such high valuations. I’ve previously said that China’s overheated Internet space is in the midst of a much needed correction, which is already starting to see valuations for many companies come down. By the time the bubble finally finishes bursting, look for valuations of many of DST’s investments, and Internet companies in general, to be quite a bit lower than figures now in the market, more in line with peers from the US and Europe.

When historians write about the China Internet bubble of 2011-2012 years from now, they are likely to feature Russia’s Digital Sky Technologies (DST) as perhaps the biggest foreign force that pumped in big sums of money and drove up valuations to unsustainable levels. The company, which rose to prominence as an early investor in Facebook (Nasdaq: FB), has been a steady investor in Chinese Internet companies, and is now making headlines yet again with another reported purchase of a stake in Xiaomi, an up-and-coming maker of low-cost, high-performance smartphones. (Chinese article) The Chinese headlines are buzzing with news of this major new investment in Xiaomi, including an interesting twist that saw Internet giant Tencent (HKEx: 700) withdraw from the new investor group after Xiaomi refused to shutter one of its services that competed with Tencent’s Weixin instant messaging service. But I’m digressing from the main subject of this posting, which is that DST has become a major force behind China’s Internet bubble, repeatedly making big new investments that drive up valuations for some interesting start-ups — many of them money-losing companies — to overinflated levels. In a similar pattern seen in DST’s previous investments, unnamed sources in this instance are saying this new capital raising values Xiaomi at around $4 billion — a number that puts it in the same ranks as much older names like Sina (Nasdaq: SINA) and NetEase (Nasdaq: NTES) that have much longer operating histories. I have little doubt that the unnamed sources in this case are inside DST, as similar unnamed sources have also flouted sky-high valuations after DST made other recent investments in e-commerce leaders Alibaba (previous post) and Jingdong Mall, which also goes by the name 360Buy. (previous post) I wrote about Xiaomi earlier this year, as it really does look like an interesting company that is full of market potential due to its niche as maker of low-cost, high-performance smartphones that sell for around $300 each. (previous post) The company previously raised around $90 million in new funding last year, and counts such big names as Singapore’s Temasek, leading chipmaker Qualcomm (Nasdaq: QCOM) and tech investment specialist IDG among its earlier investors. Furthermore, its CEO disclosed late last year that it sold nearly 400,000 of its first smartphone in 2011, and hinted its major new customers could include China Unicom (HKEx: 762; NYSE: CHU), China’s second largest wireless carrier. This kind of early progress is certainly encouraging, though I sincerely believe that DST isn’t doing Xiaomi or any of its other investments any favors by giving them more money than they probably need and filling the market with such high valuations. I’ve previously said that China’s overheated Internet space is in the midst of a much needed correction, which is already starting to see valuations for many companies come down. By the time the bubble finally finishes bursting, look for valuations of many of DST’s investments, and Internet companies in general, to be quite a bit lower than figures now in the market, more in line with peers from the US and Europe.

Bottom line: Russia’s Digital Sky is adding to China’s Internet bubble by investing in companies at inflated valuations, which will come down sharply by the time a current correction ends.

Related postings 相关文章:

◙ Xiaomi: A Fresh Face In Smartphones 小米:智能手机新面孔

◙ More Internet Froth in Alibaba Valuation, Dangdang Price War 阿里巴巴估值奇高凸显网络泡沫

◙ 360Buy — More Details But Still Pricey 京东商城值多少?

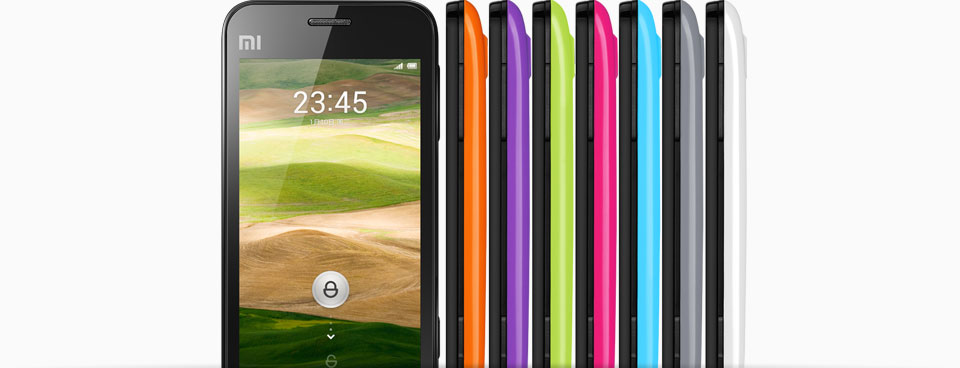

A start-up smartphone maker named Xiaomi has been bubbling up regularly in the headlines since launching its inaugural low-cost, high-performance Android smartphone in August, but what finally caught my attention were some numbers that look impressive in terms of both investment and sales. The company, clearly looking to inject some buzz into its flagship product, held a press conference this week, where CEO Lei Jun told the world that Xiaomi has sold nearly 400,000 of its MI-ONE phones so far, and hinted that China Unicom (HKEx: 762), the country’s second biggest mobile carrier, has placed orders for more than 1 million more. (

A start-up smartphone maker named Xiaomi has been bubbling up regularly in the headlines since launching its inaugural low-cost, high-performance Android smartphone in August, but what finally caught my attention were some numbers that look impressive in terms of both investment and sales. The company, clearly looking to inject some buzz into its flagship product, held a press conference this week, where CEO Lei Jun told the world that Xiaomi has sold nearly 400,000 of its MI-ONE phones so far, and hinted that China Unicom (HKEx: 762), the country’s second biggest mobile carrier, has placed orders for more than 1 million more. (