Turbulence continues to pelt China’s e-commerce sector, with new reports showing how rampant competition is pushing up costs as an industry regulator gets looks into anti-monopoly claims against top online mall operator Taobao Mall. A new foreign media report cites the top executive at luxury e-commerce site Xiu.com saying that rents for the massive warehouses required by most online merchants have soared in the last year, as players like 360Buy and Wal-Mart-invested (NYSE: WMT) Yihaodian all vie for facilities near major cities where they can store and then ship their goods. (English article) Global e-commerce leader Amazon (Nasdaq: AMZN) has joined the fray, announcing last week that its China operation was opening a 120,000 square meter facility in the city of Kunshan, not far from Shanghai, quadrupling its warehouse space in the affluent Yangtze River Delta region. (previous post) The soaring warehouse rents are just the latest headache for the overheated e-commerce sector, where most major players are already hemorrhaging money as the industry heads for a much needed consolidation that is likely to come by the middle of next year. Meantime, domestic media report the Commerce Ministry is entering the e-commerce fray by launching an anti-monopoly investigation into Taobao Mall, Alibaba’s B2C operation, in response to merchant complaints that the online mall operator used its dominant position to unilaterally force a massive fee hike on its merchants, leading many small- and mid-sized sellers to rebel. (English article) I personally think this latest Commerce Ministry investigation is a bit misguided, as there’s plenty of competition in the e-commerce space though less so in the online mall sector. If the ministry really wants to chase someone for anti-monopoly violations, it should focus on online search leader Baidu (Nasdaq: BIDU), which controls nearly 80 percent of the market.

Turbulence continues to pelt China’s e-commerce sector, with new reports showing how rampant competition is pushing up costs as an industry regulator gets looks into anti-monopoly claims against top online mall operator Taobao Mall. A new foreign media report cites the top executive at luxury e-commerce site Xiu.com saying that rents for the massive warehouses required by most online merchants have soared in the last year, as players like 360Buy and Wal-Mart-invested (NYSE: WMT) Yihaodian all vie for facilities near major cities where they can store and then ship their goods. (English article) Global e-commerce leader Amazon (Nasdaq: AMZN) has joined the fray, announcing last week that its China operation was opening a 120,000 square meter facility in the city of Kunshan, not far from Shanghai, quadrupling its warehouse space in the affluent Yangtze River Delta region. (previous post) The soaring warehouse rents are just the latest headache for the overheated e-commerce sector, where most major players are already hemorrhaging money as the industry heads for a much needed consolidation that is likely to come by the middle of next year. Meantime, domestic media report the Commerce Ministry is entering the e-commerce fray by launching an anti-monopoly investigation into Taobao Mall, Alibaba’s B2C operation, in response to merchant complaints that the online mall operator used its dominant position to unilaterally force a massive fee hike on its merchants, leading many small- and mid-sized sellers to rebel. (English article) I personally think this latest Commerce Ministry investigation is a bit misguided, as there’s plenty of competition in the e-commerce space though less so in the online mall sector. If the ministry really wants to chase someone for anti-monopoly violations, it should focus on online search leader Baidu (Nasdaq: BIDU), which controls nearly 80 percent of the market.

Bottom line: Soaring warehouse rents are the latest sign of overheating in China’s e-commerce space, which is also facing the threat of increasingly heavy-handed regulation by Beijing.

Related postings 相关文章:

◙ Amazon Name Shift Signals China Ramp-Up 亚马逊改名背后折射中国野心

◙ Albaba Faces New Assaults From Merchants, 360Buy 阿里巴巴受到中小商户和京东商城的双重夹攻

◙ China Regulors Threaten E-Commerce, Group Buying 官方监管威胁到电子商务与团购业务

E-commerce leader Alibaba Group looks set to soon get its long-awaited wish for separation from major stakeholder Yahoo (Nasdaq: YHOO), but it won’t have much time to celebrate as new fires seem to be popping up everywhere for nearly all of its major businesses. The latest crisis for the increasingly embattled company has cropped up at its Etao search site, which Alibaba is trying to build up as a specialist in e-commerce searches that can eventually rival online search titan Baidu (Nasdaq: BIDU). Chinese media are reporting that Etao has confirmed that it is no longer indexing search information from sites for a number of major online retailers, including general merchandiser Dangdang (NYSE: DANG) and electronics giant Suning (Shenzhen: 002024) (

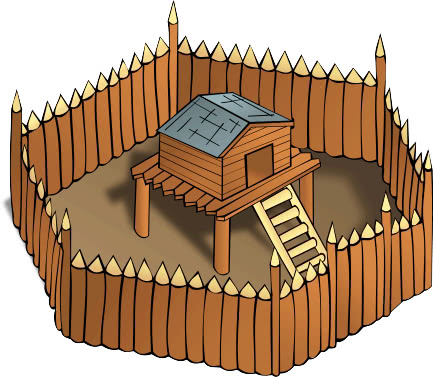

E-commerce leader Alibaba Group looks set to soon get its long-awaited wish for separation from major stakeholder Yahoo (Nasdaq: YHOO), but it won’t have much time to celebrate as new fires seem to be popping up everywhere for nearly all of its major businesses. The latest crisis for the increasingly embattled company has cropped up at its Etao search site, which Alibaba is trying to build up as a specialist in e-commerce searches that can eventually rival online search titan Baidu (Nasdaq: BIDU). Chinese media are reporting that Etao has confirmed that it is no longer indexing search information from sites for a number of major online retailers, including general merchandiser Dangdang (NYSE: DANG) and electronics giant Suning (Shenzhen: 002024) ( Embattled Chinese e-commerce leader Alibaba is looking more and more like a fortress under attack these days, facing assaults on two fronts in the latest chapter of its ongoing spats with the rest of the online world. The first and more serious of those spats has seen smaller online merchants, upset over huge fee hikes at Taobao Mall, Alibaba’s main B2C site, launch an assault on Alibaba’s Alipay electronic payments site, according to domestic media reports. (

Embattled Chinese e-commerce leader Alibaba is looking more and more like a fortress under attack these days, facing assaults on two fronts in the latest chapter of its ongoing spats with the rest of the online world. The first and more serious of those spats has seen smaller online merchants, upset over huge fee hikes at Taobao Mall, Alibaba’s main B2C site, launch an assault on Alibaba’s Alipay electronic payments site, according to domestic media reports. ( After standing aside and letting its online sector develop largely unhindered for the last decade, China is suddenly showing a worrisome trend of trying to regulate everything on its often unruly Internet, a move that, while needed, could also interfere with market forces. In separate developments on the same day, media are reporting Beijing is preparing to regulate both its group buying sites as well as its e-commerce sector to bring more order to these spaces that have become ultra-competitive in the last 1-2 years. (

After standing aside and letting its online sector develop largely unhindered for the last decade, China is suddenly showing a worrisome trend of trying to regulate everything on its often unruly Internet, a move that, while needed, could also interfere with market forces. In separate developments on the same day, media are reporting Beijing is preparing to regulate both its group buying sites as well as its e-commerce sector to bring more order to these spaces that have become ultra-competitive in the last 1-2 years. ( company is “very interested” in Yahoo (Nasdaq: YHOO), the struggling global search player which also happens to own 40 percent of Alibaba. (

company is “very interested” in Yahoo (Nasdaq: YHOO), the struggling global search player which also happens to own 40 percent of Alibaba. ( The latest signs of froth in China’s bulging Internet bubble are popping up in several places this week, with new investors in e-commerce leader Alibaba Group boasting a ridiculously high valuation for the company, while the latest price war by Dangdang (NYSE: DANG) underscores the overheated competition. And in perhaps the most revealing of the new developments, even state-owned dinosaur CCTV is jumping on the e-commerce bandwagon, with the launch of its CNTV Mall. (

The latest signs of froth in China’s bulging Internet bubble are popping up in several places this week, with new investors in e-commerce leader Alibaba Group boasting a ridiculously high valuation for the company, while the latest price war by Dangdang (NYSE: DANG) underscores the overheated competition. And in perhaps the most revealing of the new developments, even state-owned dinosaur CCTV is jumping on the e-commerce bandwagon, with the launch of its CNTV Mall. ( It’s only 3 months since Alibaba split its consumer-oriented Taobao Website into two units, and already it’s starting to hype the more promising of the two, the B2C-focused Taobao Mall, in what’s no doubt the run-up to an IPO that could come as soon as next year. At the same time, Alibaba.com (HKEx: 1688) is continuing with its battle to win back credibility following a scandal earlier this year, in a clear divergence of strategy for these two sister companies that are both part of Chinese e-commerce leader Alibaba Group. Let’s look at Taobao Mall first. The 3-month-old company has held what was probably its first stand-alone press conference, in which it boasted it expects its sales volume to double to 200 billion yuan next year, or about $31 billion, and where it announced a new strategy where it will open its site to other online retailers like Wal-Mart-invested (NYSE: WMT) Yihaodian in addition to traditional retail names like Dell. (Nasdaq: DELL) (

It’s only 3 months since Alibaba split its consumer-oriented Taobao Website into two units, and already it’s starting to hype the more promising of the two, the B2C-focused Taobao Mall, in what’s no doubt the run-up to an IPO that could come as soon as next year. At the same time, Alibaba.com (HKEx: 1688) is continuing with its battle to win back credibility following a scandal earlier this year, in a clear divergence of strategy for these two sister companies that are both part of Chinese e-commerce leader Alibaba Group. Let’s look at Taobao Mall first. The 3-month-old company has held what was probably its first stand-alone press conference, in which it boasted it expects its sales volume to double to 200 billion yuan next year, or about $31 billion, and where it announced a new strategy where it will open its site to other online retailers like Wal-Mart-invested (NYSE: WMT) Yihaodian in addition to traditional retail names like Dell. (Nasdaq: DELL) ( After several years of near-nonstop hype about the potential of e-commerce in China, notorious China short seller Carson Block and leading e-commerce operator Alibaba Group are both finally waking up to the same reality that much of the talk is vastly exaggerated. In many ways, this reality should come as no surprise to anyone, as even bullish market watchers say that all online sales in China stood at a relatively modest $50 billion last year. So even if they double over the next 2-3 years, we’re still only looking at $100 billion in overall sales by 2015 — a fraction of levels in developed markets like the US and hardly enough to support the huge number of online merchants that have exploded onto the scene in China with billions of dollars in new funding over the last year. According to one media report, Carson Block, who does business through his firm, Muddy Waters, said many Western investors see a small segment of newly wealthy Chinese consumers in big cities like Beijing and Shanghai, and mistakenly extrapolate that to the entire nation of 1.3 billion, even though a big majority of those people live on annual incomes of $2,000 or less. (

After several years of near-nonstop hype about the potential of e-commerce in China, notorious China short seller Carson Block and leading e-commerce operator Alibaba Group are both finally waking up to the same reality that much of the talk is vastly exaggerated. In many ways, this reality should come as no surprise to anyone, as even bullish market watchers say that all online sales in China stood at a relatively modest $50 billion last year. So even if they double over the next 2-3 years, we’re still only looking at $100 billion in overall sales by 2015 — a fraction of levels in developed markets like the US and hardly enough to support the huge number of online merchants that have exploded onto the scene in China with billions of dollars in new funding over the last year. According to one media report, Carson Block, who does business through his firm, Muddy Waters, said many Western investors see a small segment of newly wealthy Chinese consumers in big cities like Beijing and Shanghai, and mistakenly extrapolate that to the entire nation of 1.3 billion, even though a big majority of those people live on annual incomes of $2,000 or less. ( Yihaodian, the online merchant that made headlines earlier this year when it got an investment from global retail giant Wal-Mart (NYSE: WMT) (

Yihaodian, the online merchant that made headlines earlier this year when it got an investment from global retail giant Wal-Mart (NYSE: WMT) (