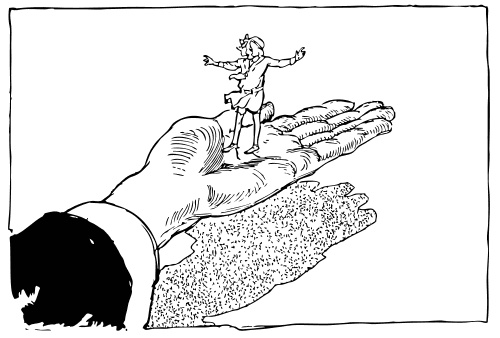

When is 80 percent growth nothing to get excited about? When you’re Baidu (Nasdaq: BIDU), China’s leading search engine, whose latest earnings report featuring 82.5 percent revenue growth and a 77 percent jump in profit is being greeted largely with yawns from investors who have come to expect this kind of turbo-charged growth from China’s Internet star. (earnings announcement) Baidu’s outlook for the first quarter was equally upbeat, with the company forecasting revenue growth of about 75 percent for the current reporting period. Shareholders bid up Baidu stock by 2.5 percent after the report came out, a modest gain reflecting the fact that the results and the guidance were mostly in line with expectation. I’ve looked over the report and there’s really not much of note in there. The company continues to be a one-note story, with nearly all of its revenue coming from its core online advertising services, which were up 82 percent for the quarter. Growth in revenue per customer seems to be slowing, up just 5 percent from the previous quarter, perhaps reflecting the fatigue that customers are starting to feel at having Baidu continually squeeze them for more money. Of course, when your investors start to expect 80 percent growth from you each quarter, the biggest danger is that they will punish you when you start to post lower numbers, which is almost inevitable. Leading web portal Sina (Nasdaq: SINA) learned that lesson the hard way last year, when expectations for its incredibly popular Weibo microblogging site grew a bit too big, fueling a rapid rise in Sina’s shares, which then tumbled almost as quickly after Weibo ran into some regulatory obstacles and also showed signs of inability to quickly make money. (previous post) I still think China’s online ad market is due for a rapid slowdown later this year when the country’s current Internet bubble starts to burst. On top of that, some rival search engines are starting to gain some traction against Baidu, including Sohu’s (Nasdaq: SOHU) Sogou and perhaps more importantly Tencent’s (HKEx: 700) Soso, which seems to be gaining more momentum lately. All things considered, I wouldn’t be surprised to see Baidu’s turbo-charged growth fade somewhat by the end of this year, falling to the 50 percent level or perhaps even lower. When that happens, look for investors to punish its stock much the way they did to Sina last year.

Bottom line: Baidu’s continued turbo-charged growth has set investor expectations unreasonably high, with a slowdown that will deal a hit to its stock likely by the end of the year.

Related postings 相关文章:

◙ Baidu Dreams of Brazil 百度试水巴西

Chinese telecoms star Huawei seems to be in a state of constant change these days in its bid to shed its image as a stodgy government-controlled company, with new comments from Ren Zhengfei indicating its media-shy founder may be preparing to step down soon. Ren’s departure, if it really happens, could remove one of the biggest PR obstacles for Huawei in its drive for global respect, since many of the questions about the company’s government and military ties stem from his past as an army engineer and a stealthy demeanor that has seen him grant only a handful of interviews in Huawei’s history. According to reports in the Chinese media, Ren has said that if Huawei employees believe he is unneeded and voice a desire for him to go, then he thinks that would be a good thing. (

Chinese telecoms star Huawei seems to be in a state of constant change these days in its bid to shed its image as a stodgy government-controlled company, with new comments from Ren Zhengfei indicating its media-shy founder may be preparing to step down soon. Ren’s departure, if it really happens, could remove one of the biggest PR obstacles for Huawei in its drive for global respect, since many of the questions about the company’s government and military ties stem from his past as an army engineer and a stealthy demeanor that has seen him grant only a handful of interviews in Huawei’s history. According to reports in the Chinese media, Ren has said that if Huawei employees believe he is unneeded and voice a desire for him to go, then he thinks that would be a good thing. ( Social networking (SNS) leader Facebook and animation giant DreamWorks Animation (NYSE: DWA) have both made new moves in their drives to enter China, as both seek to tap a massive media market of hundreds of millions of customers who are finally showing signs of willingness to pay for their entertainment. Let’s look at Facebook first, whose sights are now focused on its high anticipated US IPO to raise billions of dollars. Local media are reporting Facebook has just registered dozens of trademarks in China (

Social networking (SNS) leader Facebook and animation giant DreamWorks Animation (NYSE: DWA) have both made new moves in their drives to enter China, as both seek to tap a massive media market of hundreds of millions of customers who are finally showing signs of willingness to pay for their entertainment. Let’s look at Facebook first, whose sights are now focused on its high anticipated US IPO to raise billions of dollars. Local media are reporting Facebook has just registered dozens of trademarks in China ( After questioning most of Internet search leader Baidu’s (Nasdaq: BIDU) recent net initiatives as misguided, I’m happy to say it’s finally making a new and potentially promising move by exploring an expansion into Brazil. (

After questioning most of Internet search leader Baidu’s (Nasdaq: BIDU) recent net initiatives as misguided, I’m happy to say it’s finally making a new and potentially promising move by exploring an expansion into Brazil. ( The latest earnings results from real estate and online game bellwethers SouFun (NYSE: SFUN) and NetEase (Nasdaq: NTES) are showing a broader story of slowing growth, with the former in danger of slipping into the red while the latter needs to rein in its rapidly rising costs. Let’s look at SouFun first, which is taking a hit from China’s stagnating real estate market. Despite rapidly falling prices and anemic transaction volumes, SouFun managed to post 18 percent revenue growth for the quarter, which was sharply lower than its 53 percent growth for the year. (

The latest earnings results from real estate and online game bellwethers SouFun (NYSE: SFUN) and NetEase (Nasdaq: NTES) are showing a broader story of slowing growth, with the former in danger of slipping into the red while the latter needs to rein in its rapidly rising costs. Let’s look at SouFun first, which is taking a hit from China’s stagnating real estate market. Despite rapidly falling prices and anemic transaction volumes, SouFun managed to post 18 percent revenue growth for the quarter, which was sharply lower than its 53 percent growth for the year. ( New data is showing that Hewlett-Packard’s (NYSE: HPQ) share of China’s PC market continued to plummet at the end of last year, a worrisome development for a company that is at once the world’s biggest computer brand but also seems unable to decide on its future direction in a PC market that will soon overtake the US to become the world’s largest. According to the latest data from IDC, HP’s share of the China PC market tumbled to 5.3 percent in the fourth quarter of last year, down from 8.5 percent in the second quarter, which was down from double-digits not long before when the company was one of China’s top players. (

New data is showing that Hewlett-Packard’s (NYSE: HPQ) share of China’s PC market continued to plummet at the end of last year, a worrisome development for a company that is at once the world’s biggest computer brand but also seems unable to decide on its future direction in a PC market that will soon overtake the US to become the world’s largest. According to the latest data from IDC, HP’s share of the China PC market tumbled to 5.3 percent in the fourth quarter of last year, down from 8.5 percent in the second quarter, which was down from double-digits not long before when the company was one of China’s top players. (