A pair of new reports in the Chinese media appear to be readying markets for news that the nation’s banks are on the brink of a crisis, even as Beijing is already devising ways to save them from the flood of bad loans that everyone is expecting. Let’s look at the bigger of the 2 reports first, which has China’s banking regulator expressing surprise at the “contradictory” fact that China’s top banks have yet to report significant rises in their non-performing loans (NPLs), even though many have seen recent surges in some categories of loans considered “problematic”. (English article) The article goes into a bit of detail after that, but the implication is rather straightforward. In a nutshell, the regulator thinks the banks are lying about the magnitude of their bad loan problem, using word games to classify loans as “problematic” even when they are already clearly “non-performing” by industry standards. This kind of word game is completely standard procedure for big Chinese state-owned enterprises (SOEs) that are always eager to give the central government good news, which often means hiding their problems behind this kind of accounting trick. That eagerness was on display in their recently released first-quarter earnings reports, when top lender ICBC (HKEx: 1398; Shanghai: 601398) reported its NPL ratio at the end of March was a sparkling 0.89 percent, while Bank of China (HKEx: 3988; Shanghai: 601988), the industry’s third largest lender, reported an equally stellar NPL rate of 0.97 percent. The banks continue to say there’s no problem, even as just about everyone else suspects they are sitting on a growing pile of bad loans made during a lending binge that was part of Beijing’s economic 4 trillion yuan economic stimulus package at the height of the global downturn in 2009 and 2010. Many of those loans went to local governments for unnecessary infrastructure projects that had no real income sources with which to replay the debt. Most government were expecting to use land sales, which make up their main revenue source, to repay the debt; but that plan is quickly falling into doubt as Beijing shows no signs of easing policies to rein in the overheated real estate market, which has also dampened demand for new land for development. Earlier this year, Beijing indicated it might let the banks “restructure” many of their problematic loans to forestall the looming crisis, essentially allowing them to stop collecting payments for a year or 2 without officially classifying the loans as non-performing. (previous post) It’s unclear if the government ever officially gave the green light for that plan to go forward, but even if it didn’t many observers suspect the banks are using this and other similar accounting tactics to cover up the problems. Following this latest new probe by the regulator, I expect we’ll see most of the banks start to admit to their loan problems in the months ahead, with most confessing to NPL ratios of 3 percent or more by year end. In anticipation of that problem, Beijing is taking what looks to me like a second step to give the banks a relief mechanism to spread the bad loan problem more evenly around the country’s vast SOE system. That appears to be the message from the second piece of news I referred to at the start of this piece, which has Beijing launching a pilot program that will allow banks to securitize their loans and sell them off to other “investors”. (English article) I don’t mean to sound too cynical, but this program, which is starting with a relatively modest quota of 50 billion yuan, or less than $10 billion, looks suspiciously like a way for the banks to sell their bad loans to other major cash-rich SOEs if and when that becomes necessary. In a way, this kind of plan looks smart in helping to minimize the downside for individual companies by spreading the risk around a much wider base. But stock buyers who invest in these SOEs may hardly find that news comforting when, for example, investors in a big SOE like Sinopec (HKEx: 386; NYSE: SNP; Shanghai: 600028) suddenly discover their company is holding billions of dollars in securitized bad loans it purchased under orders from Beijing. Stay tuned for more of these kinds of smoke-and-mirror games as Beijing figures out how it wants to handle this looming financial mess and forces banks to admit to the problem.

Bottom line: Suspicions from China’s banking regulator indicate Beijing is making preparations to deal with its looming banking crisis, with potential plans to spread bad loans around the SOE system.

Related postings 相关文章:

◙ Goldman Flees ICBC as Bank Crisis Looms 中国银行业危机隐现 高盛迅速转让工行股票

◙ AgBank Results: First Look at Banking Winter 中国农业银行财报:银行业的冬天

◙ China Considers New Bank Rescue 中国考虑出台措施援救银行

I hope readers will excuse me for my headline calling an upcoming IPO by China’s top nuclear power company “too hot to handle,” but in all honesty that’s really what I think about this plan, which seems ill conceived and likely to highlight just how unpopular nuclear power is right now. The plan being discussed has just been approved by China’s environmental regulator, and would see China National Nuclear Power Co raise funds to develop $27 billion worth of projects in its pipeline. (

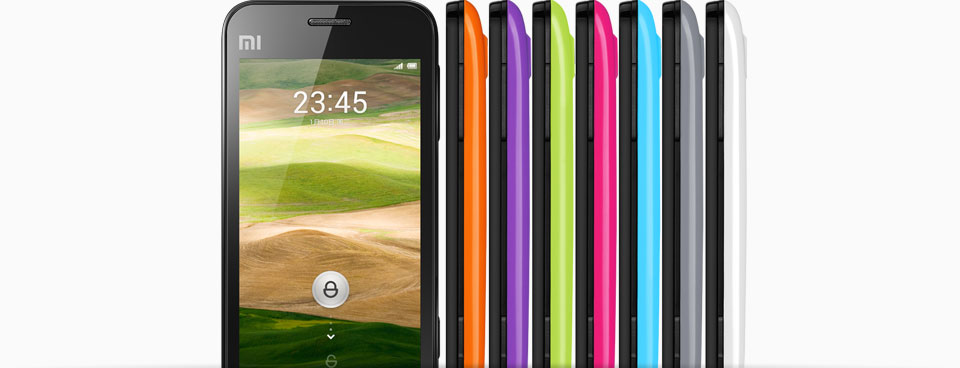

I hope readers will excuse me for my headline calling an upcoming IPO by China’s top nuclear power company “too hot to handle,” but in all honesty that’s really what I think about this plan, which seems ill conceived and likely to highlight just how unpopular nuclear power is right now. The plan being discussed has just been approved by China’s environmental regulator, and would see China National Nuclear Power Co raise funds to develop $27 billion worth of projects in its pipeline. ( When historians write about the China Internet bubble of 2011-2012 years from now, they are likely to feature Russia’s Digital Sky Technologies (DST) as perhaps the biggest foreign force that pumped in big sums of money and drove up valuations to unsustainable levels. The company, which rose to prominence as an early investor in Facebook (Nasdaq: FB), has been a steady investor in Chinese Internet companies, and is now making headlines yet again with another reported purchase of a stake in Xiaomi, an up-and-coming maker of low-cost, high-performance smartphones. (

When historians write about the China Internet bubble of 2011-2012 years from now, they are likely to feature Russia’s Digital Sky Technologies (DST) as perhaps the biggest foreign force that pumped in big sums of money and drove up valuations to unsustainable levels. The company, which rose to prominence as an early investor in Facebook (Nasdaq: FB), has been a steady investor in Chinese Internet companies, and is now making headlines yet again with another reported purchase of a stake in Xiaomi, an up-and-coming maker of low-cost, high-performance smartphones. ( A sudden flurry of aviation news in the Chinese media leads me to suspect the government has issued a new directive for the country’s airlines to be more global, setting the stage for what could be an interesting worldwide expansion that could even include some mergers and acquisitions. Of course, I’m ultimately quite cynical about this kind of government directive, if that’s indeed what is driving this recent flurry of news, as it’s a typical move driven by central leaders in Beijing rather than market forces. But that said, I shouldn’t downplay the importance of support from Beijing for this new global drive, since the success of any global expansion will clearly require such support. Let’s look at the flurry of news first to give a flavor of what’s happening. Leading off the reports, Sichuan Airlines is in the headlines as it becomes one of China’s first regional carriers to launch international service to a Western market, in this case to the Canadian city of Vancouver. (

A sudden flurry of aviation news in the Chinese media leads me to suspect the government has issued a new directive for the country’s airlines to be more global, setting the stage for what could be an interesting worldwide expansion that could even include some mergers and acquisitions. Of course, I’m ultimately quite cynical about this kind of government directive, if that’s indeed what is driving this recent flurry of news, as it’s a typical move driven by central leaders in Beijing rather than market forces. But that said, I shouldn’t downplay the importance of support from Beijing for this new global drive, since the success of any global expansion will clearly require such support. Let’s look at the flurry of news first to give a flavor of what’s happening. Leading off the reports, Sichuan Airlines is in the headlines as it becomes one of China’s first regional carriers to launch international service to a Western market, in this case to the Canadian city of Vancouver. ( After reports emerged last week that e-commerce giant Jingdong Mall’s on-again-off-again IPO was on again, it now appears the company is fast-tracking the deal with plans to list as soon as September, providing a big test for the anemic market for Chinese Internet IPOs in the US. It’s still too early to say how this IPO will fare, since it’s still at least 4 months away and a lot can happen to broader market sentiment in that time. Reports last week said that revenue at Jingdong, which also is known as 360Buy, reached 21 billion yuan and are expected to double this year. (

After reports emerged last week that e-commerce giant Jingdong Mall’s on-again-off-again IPO was on again, it now appears the company is fast-tracking the deal with plans to list as soon as September, providing a big test for the anemic market for Chinese Internet IPOs in the US. It’s still too early to say how this IPO will fare, since it’s still at least 4 months away and a lot can happen to broader market sentiment in that time. Reports last week said that revenue at Jingdong, which also is known as 360Buy, reached 21 billion yuan and are expected to double this year. ( Oil exploration giant CNOOC (HKEx: 883; NYSE: CEO) is probably starting to wish it had never partnered with ConocoPhillips (NYSE: COP) to develop oil fields in the Bohai Bay off the northeast China coast, following word that yet another leak has occurred at the problematic project. Frankly speaking, it’s hard to determine how bad the latest spill was at the Penglai oil fields being developed by ConocoPhillips in this troubled joint venture with CNOOC. The latest announcement from CNOOC indicates the spill was relatively minor, with around half a ton of oil leaked into the sea, all of which has already been cleaned up. (

Oil exploration giant CNOOC (HKEx: 883; NYSE: CEO) is probably starting to wish it had never partnered with ConocoPhillips (NYSE: COP) to develop oil fields in the Bohai Bay off the northeast China coast, following word that yet another leak has occurred at the problematic project. Frankly speaking, it’s hard to determine how bad the latest spill was at the Penglai oil fields being developed by ConocoPhillips in this troubled joint venture with CNOOC. The latest announcement from CNOOC indicates the spill was relatively minor, with around half a ton of oil leaked into the sea, all of which has already been cleaned up. ( An interesting trend is happening in China’s fledgling hotel space, where operators are diversifying their offerings by acquiring new brands in a bid to keep growing and appeal to a wider range of customers. China Lodging Group (Nasdaq: HTHT) has become the latest operator to make a move in that direction, announcing it has increased its stake in the Starway hotel chain to become the brand’s majority shareholder. (

An interesting trend is happening in China’s fledgling hotel space, where operators are diversifying their offerings by acquiring new brands in a bid to keep growing and appeal to a wider range of customers. China Lodging Group (Nasdaq: HTHT) has become the latest operator to make a move in that direction, announcing it has increased its stake in the Starway hotel chain to become the brand’s majority shareholder. ( Renren (NYSE: RENN) investors tired of seeing losses quarter after quarter could soon have another alternative as China’s leading social networking site reportedly plans to spin off its online game unit into a separately listed company. If true, the news would mark the latest plan by an Internet company to spin off an individual business into a separate unit, as part of a broader trend by this sector to provide investors with clearer choices focused on specific businesses like games or e-commerce. Many of China’s Internet companies, especially the older ones, often have lots of different businesses, from portals, to games, e-commerce and social networking, under a single company. One or more of the businesses are often profitable and end up subsidizing the others that are losing money — frustrating investors who might like the profitable units but care less for the loss-making ones. In this latest case, media are citing unnamed sources saying Renren is crafting a plan to spin off its game unit by September, and would eventually list the business separately with an IPO. (

Renren (NYSE: RENN) investors tired of seeing losses quarter after quarter could soon have another alternative as China’s leading social networking site reportedly plans to spin off its online game unit into a separately listed company. If true, the news would mark the latest plan by an Internet company to spin off an individual business into a separate unit, as part of a broader trend by this sector to provide investors with clearer choices focused on specific businesses like games or e-commerce. Many of China’s Internet companies, especially the older ones, often have lots of different businesses, from portals, to games, e-commerce and social networking, under a single company. One or more of the businesses are often profitable and end up subsidizing the others that are losing money — frustrating investors who might like the profitable units but care less for the loss-making ones. In this latest case, media are citing unnamed sources saying Renren is crafting a plan to spin off its game unit by September, and would eventually list the business separately with an IPO. (