Leading Chinese media company CCTV has been trumpeting the results of its annual advertising auction for 2013 held over the weekend, which saw spending increase by 11.4 percent despite the recent slowdown that has hit the sector. But from my perspective, these results look very gloomy indeed for reasons I’ll explain shortly, meaning advertising-dependent Internet leaders like search engine Baidu (Nasdaq: BIDU), web portal Sina (Nasdaq: SINA) and video sharing site Youku Tudou (NYSE: YOUKU) won’t have much to cheer about in 2013.

Leading Chinese media company CCTV has been trumpeting the results of its annual advertising auction for 2013 held over the weekend, which saw spending increase by 11.4 percent despite the recent slowdown that has hit the sector. But from my perspective, these results look very gloomy indeed for reasons I’ll explain shortly, meaning advertising-dependent Internet leaders like search engine Baidu (Nasdaq: BIDU), web portal Sina (Nasdaq: SINA) and video sharing site Youku Tudou (NYSE: YOUKU) won’t have much to cheer about in 2013.

Journalist China

CCB Joins Capital Raising Queue — Again 建行获准发行400亿元人民币次级债

The near non-stop capital raising by major Chinese banks is showing no sign of slowing, with China Construction Bank (HKEx: 939; Shanghai: 601939) announcing yet another new plan to sell up to 40 billion yuan, or $6.5 billion, in subordinated debt to shore up its balance sheet. Similar to most recent cases, these bonds will be sold into the inter-bank bond market for domestic buyers, meaning that big state-backed institutions are likely to pay most of the bill for this latest recapitalization of a major Chinese bank, most of which are standing on the cusp of a major bad-loan crisis.

The near non-stop capital raising by major Chinese banks is showing no sign of slowing, with China Construction Bank (HKEx: 939; Shanghai: 601939) announcing yet another new plan to sell up to 40 billion yuan, or $6.5 billion, in subordinated debt to shore up its balance sheet. Similar to most recent cases, these bonds will be sold into the inter-bank bond market for domestic buyers, meaning that big state-backed institutions are likely to pay most of the bill for this latest recapitalization of a major Chinese bank, most of which are standing on the cusp of a major bad-loan crisis.

Sina Weibo Sniffs E-Commerce With Alibaba 阿里巴巴或牵手新浪微博

New reports over the weekend have Sina’s (Nasdaq: SINA) popular but profit-challenged Weibo microblogging service sniffing out a strategic tie-up with e-commerce leader Alibaba, in what looks like a very smart tie-up to me if it’s true. Meantime in related news, NetEase (Nasdaq: NTES) is shuttering one of its main social networking services (SNS) sites, again reflecting how difficult it is to make money in the popular but cash-poor world of SNS. Let’s take a look first at the big news regarding a potential Sina-Alibaba tie-up, which would mark a major step in the drive by Sina Weibo towards becoming profitable.

New reports over the weekend have Sina’s (Nasdaq: SINA) popular but profit-challenged Weibo microblogging service sniffing out a strategic tie-up with e-commerce leader Alibaba, in what looks like a very smart tie-up to me if it’s true. Meantime in related news, NetEase (Nasdaq: NTES) is shuttering one of its main social networking services (SNS) sites, again reflecting how difficult it is to make money in the popular but cash-poor world of SNS. Let’s take a look first at the big news regarding a potential Sina-Alibaba tie-up, which would mark a major step in the drive by Sina Weibo towards becoming profitable.

Read Full Post…

Solar: New Suntech Cuts And Shrinking Stocks 太阳能:尚德缩减产能及股票缩水

There’s a flurry of news coming from the embattled solar sector, led by a sharp cutback by Suntech (NYSE: STP) at its main US plant that looks suspiciously like it is being ordered by Beijing part of a government rescue plan for the struggling company. Meantime, JA Solar (Nasdaq: JASO) and LDK (NYSE: LDK) are struggling just to stay listed as their market values quickly evaporate. And in a rare but fleeting piece of good news, Yingli (NYSE: YGE), Trina (NYSE: TSL) and others are getting a temporary boost as they reclaim money they previously set aside but will no longer need to use as provisions in the US anti-dumping investigation against them.

There’s a flurry of news coming from the embattled solar sector, led by a sharp cutback by Suntech (NYSE: STP) at its main US plant that looks suspiciously like it is being ordered by Beijing part of a government rescue plan for the struggling company. Meantime, JA Solar (Nasdaq: JASO) and LDK (NYSE: LDK) are struggling just to stay listed as their market values quickly evaporate. And in a rare but fleeting piece of good news, Yingli (NYSE: YGE), Trina (NYSE: TSL) and others are getting a temporary boost as they reclaim money they previously set aside but will no longer need to use as provisions in the US anti-dumping investigation against them.

Chinese Smartphones on the Rise 中国智能手机崛起

Chinese smartphone makers have surged in their home market over the last year, coming from out of the blue to challenge big global names like Apple and Samsung. But their rise could be short-lived if they fail to innovate, paralleling a similar rapid rise and fall a decade ago for names like TCL (HKEx: 2618) and Ningbo Bird that are now just footnotes in the history of China’s large but highly competitive mobile market. The rapid rise of Chinese brands over the last year has been nothing short of remarkable, as China gets set to overtake the United States as the world’s largest smartphone market. At the end of last year, the market was still dominated by foreign names, with Samsung (Seoul: 005930), Nokia (Helsinki: NOK1V) and Apple (Nasdaq: AAPL) occupying three of the top four slots to control more than half of the market collectively.

Chinese smartphone makers have surged in their home market over the last year, coming from out of the blue to challenge big global names like Apple and Samsung. But their rise could be short-lived if they fail to innovate, paralleling a similar rapid rise and fall a decade ago for names like TCL (HKEx: 2618) and Ningbo Bird that are now just footnotes in the history of China’s large but highly competitive mobile market. The rapid rise of Chinese brands over the last year has been nothing short of remarkable, as China gets set to overtake the United States as the world’s largest smartphone market. At the end of last year, the market was still dominated by foreign names, with Samsung (Seoul: 005930), Nokia (Helsinki: NOK1V) and Apple (Nasdaq: AAPL) occupying three of the top four slots to control more than half of the market collectively.

China Mobile Loses Cable War 中国移动无缘有线商机

The news wires are buzzing today with word that wireless titan China Mobile (HKEx: 941; NYSE: CHL) appears to have lost a major battle to quickly become a major player in the fixed-line broadband space by purchasing a stake in a new national cable TV operator now being formed. If the reports are true, this development certainly wouldn’t surprise me since regulators in Beijing are probably quickly tiring of listing to the constant complaints coming from China Mobile, which believes it was treated unfairly in the country’s awarding of 3G wireless licenses 3 years ago.

The news wires are buzzing today with word that wireless titan China Mobile (HKEx: 941; NYSE: CHL) appears to have lost a major battle to quickly become a major player in the fixed-line broadband space by purchasing a stake in a new national cable TV operator now being formed. If the reports are true, this development certainly wouldn’t surprise me since regulators in Beijing are probably quickly tiring of listing to the constant complaints coming from China Mobile, which believes it was treated unfairly in the country’s awarding of 3G wireless licenses 3 years ago.

Earnings Friday: Sina, NetEase, Pactera 解读在美上市中国企业业绩

I’m christening today “Earnings Friday” because it’s easily the peak day of third-quarter earnings announcements for major US-listed Chinese firms, with everyone from real estate services firm E-House (NYSE: EJ) to drug maker Simcere Pharmaceutical (NYSE: SCR) releasing their results overnight. Since I have a natural bias towards tech, I’m going to focus today on the latest results from 2 of China’s oldest Internet firms, Sina (Nasdaq: SINA) and NetEase (Nasdaq: NTES), as well as its newest player Pactera (Nasdaq: PACT), which was formed just last week through the merger of former IT outsourcing leaders HiSoft and VanceInfo. (previous post)

I’m christening today “Earnings Friday” because it’s easily the peak day of third-quarter earnings announcements for major US-listed Chinese firms, with everyone from real estate services firm E-House (NYSE: EJ) to drug maker Simcere Pharmaceutical (NYSE: SCR) releasing their results overnight. Since I have a natural bias towards tech, I’m going to focus today on the latest results from 2 of China’s oldest Internet firms, Sina (Nasdaq: SINA) and NetEase (Nasdaq: NTES), as well as its newest player Pactera (Nasdaq: PACT), which was formed just last week through the merger of former IT outsourcing leaders HiSoft and VanceInfo. (previous post)

Dangdang: Past the Worst? 当当:渡过最坏时期?

A couple of interesting news bits are coming from the e-commerce space, led by the latest quarterly data from Dangdang (NYSE: DANG) that shows the worst may be past for this fast-fading sector pioneer. Meantime, we’re also getting new sales figures for the November 11 Singles Day holiday from Jingdong Mall, showing just how distant a second-place player the company is to sector-leader Alibaba.

A couple of interesting news bits are coming from the e-commerce space, led by the latest quarterly data from Dangdang (NYSE: DANG) that shows the worst may be past for this fast-fading sector pioneer. Meantime, we’re also getting new sales figures for the November 11 Singles Day holiday from Jingdong Mall, showing just how distant a second-place player the company is to sector-leader Alibaba.

ICBC Expands in Middle East 工行拓展中东业务

ICBC (HKEx: 1398; Shanghai: 601398) is easily China’s most outward-looking bank, and it is showing its global aspirations once gain with word that it plans to open branches in the Middle Eastern markets of Saudi Arabia and Kuwait. (company announcement) This latest announcement that it has received local approval to set up branches in these 2 lucrative markets comes just a week after ICBC said it has also received local regulatory approval to buy a controlling stake in the Argentine unit of South Africa’s Standard Bank, its longtime partner in Africa.

Xiaomi Bets Big on Internet TV 小米押注互联网电视

Smartphone darling Xiaomi is in the new headlines again with the release of its new Internet TV product, including interesting comments by marketing-savvy founder Lei Jun indicating he intends to pour big money into this new endeavor. Specifically, media quoted Lei saying he has invested more than $100 million to acquiring a set-top box developer for Xiaomi’s Internet TV project — quite a hefty sum for such a young company whose business scale is still relatively small. (Chinese article)

Smartphone darling Xiaomi is in the new headlines again with the release of its new Internet TV product, including interesting comments by marketing-savvy founder Lei Jun indicating he intends to pour big money into this new endeavor. Specifically, media quoted Lei saying he has invested more than $100 million to acquiring a set-top box developer for Xiaomi’s Internet TV project — quite a hefty sum for such a young company whose business scale is still relatively small. (Chinese article)

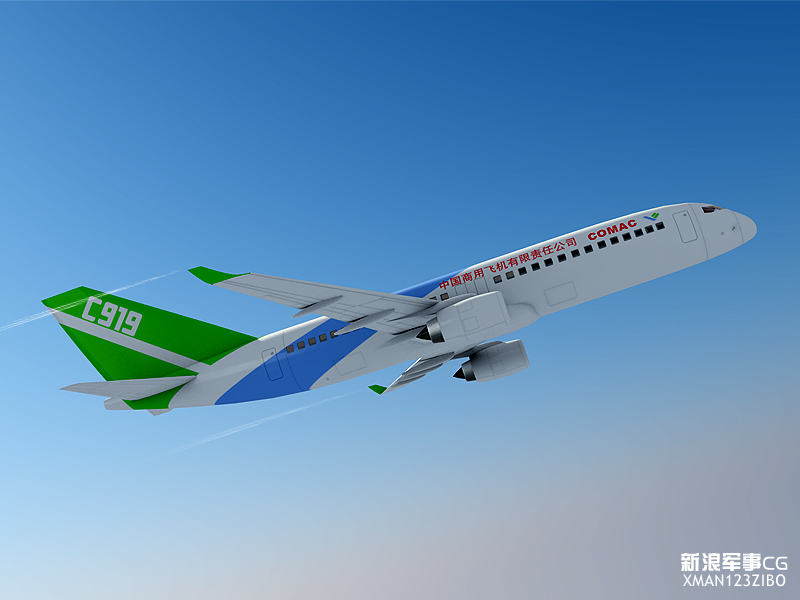

China Plane Maker Creates US Demand 中国商飞创造海外需求

If you can’t sell your products, then create a customer to buy them. That concept has been practiced for years by companies looking to sell their new products to wary buyers, with Chinese solar panel maker Suntech (NYSE: STP) most recently trying out the strategy to largely disastrous results. Now it seems that aspiring Chinese commercial aircraft maker COMAC is also trying out the strategy, with news that the company will participate in the revival of storied but now defunct US carrier Eastern Air Lines. (English article)

If you can’t sell your products, then create a customer to buy them. That concept has been practiced for years by companies looking to sell their new products to wary buyers, with Chinese solar panel maker Suntech (NYSE: STP) most recently trying out the strategy to largely disastrous results. Now it seems that aspiring Chinese commercial aircraft maker COMAC is also trying out the strategy, with news that the company will participate in the revival of storied but now defunct US carrier Eastern Air Lines. (English article)